Navigating the world of renters insurance can feel like a maze, especially when you need immediate answers or assistance. For USAA members, the path to peace of mind often starts with a simple phone call. USAA offers a range of renters insurance options designed to protect your belongings and provide financial security in the event of unforeseen circumstances. Understanding how to connect with USAA for renters insurance is crucial, and that’s where their dedicated phone lines come in.

This guide delves into the ins and outs of contacting USAA for renters insurance, providing a comprehensive overview of their phone numbers, customer service hours, and other vital information. Whether you’re seeking a quote, filing a claim, or simply have a question about your policy, this resource will equip you with the knowledge to navigate the process with ease.

USAA Renters Insurance Overview

USAA renters insurance is designed to protect renters from financial losses due to covered perils, such as fire, theft, and vandalism. It provides financial compensation to help you replace or repair your belongings and cover your liability if someone is injured on your property.

Coverage Options

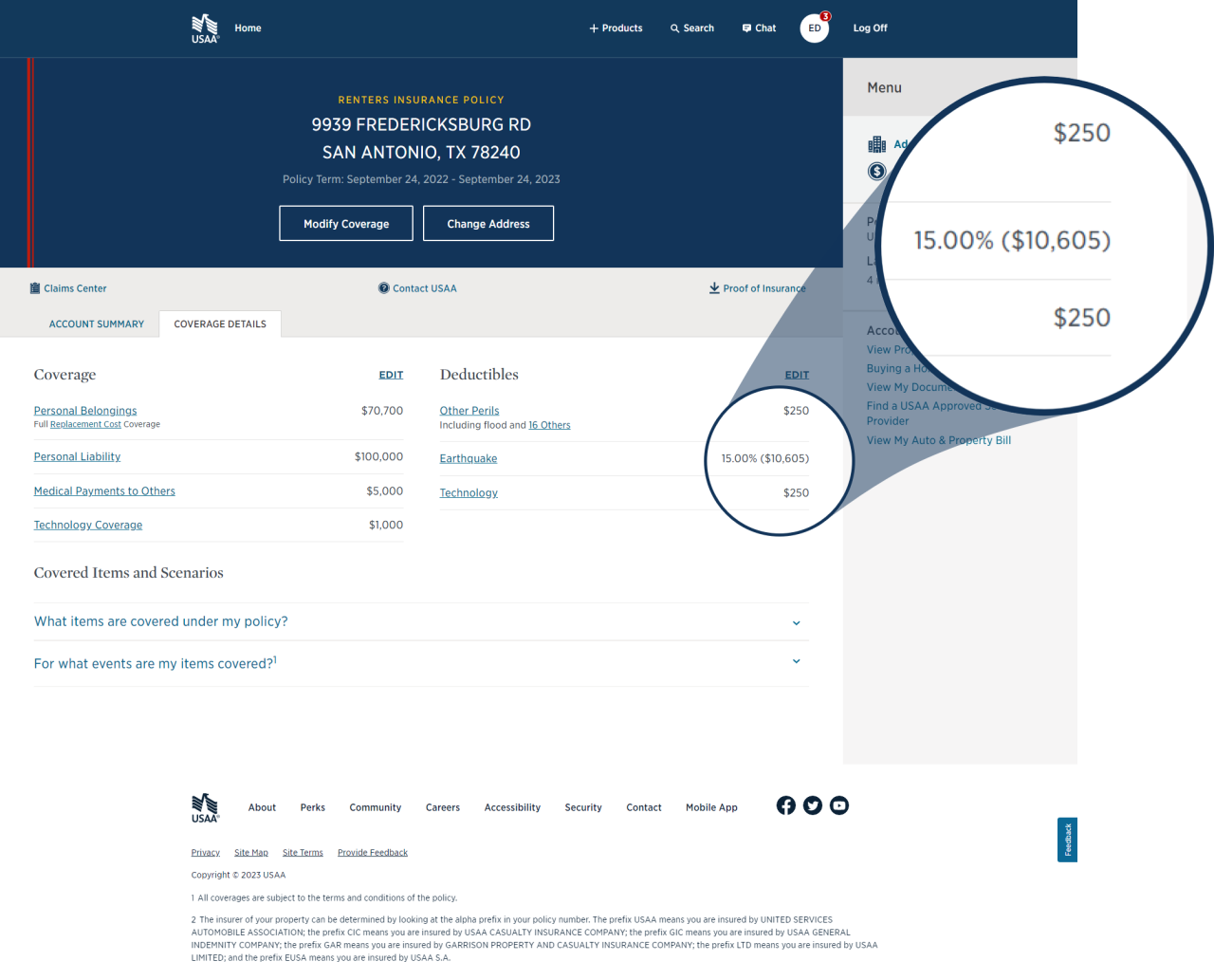

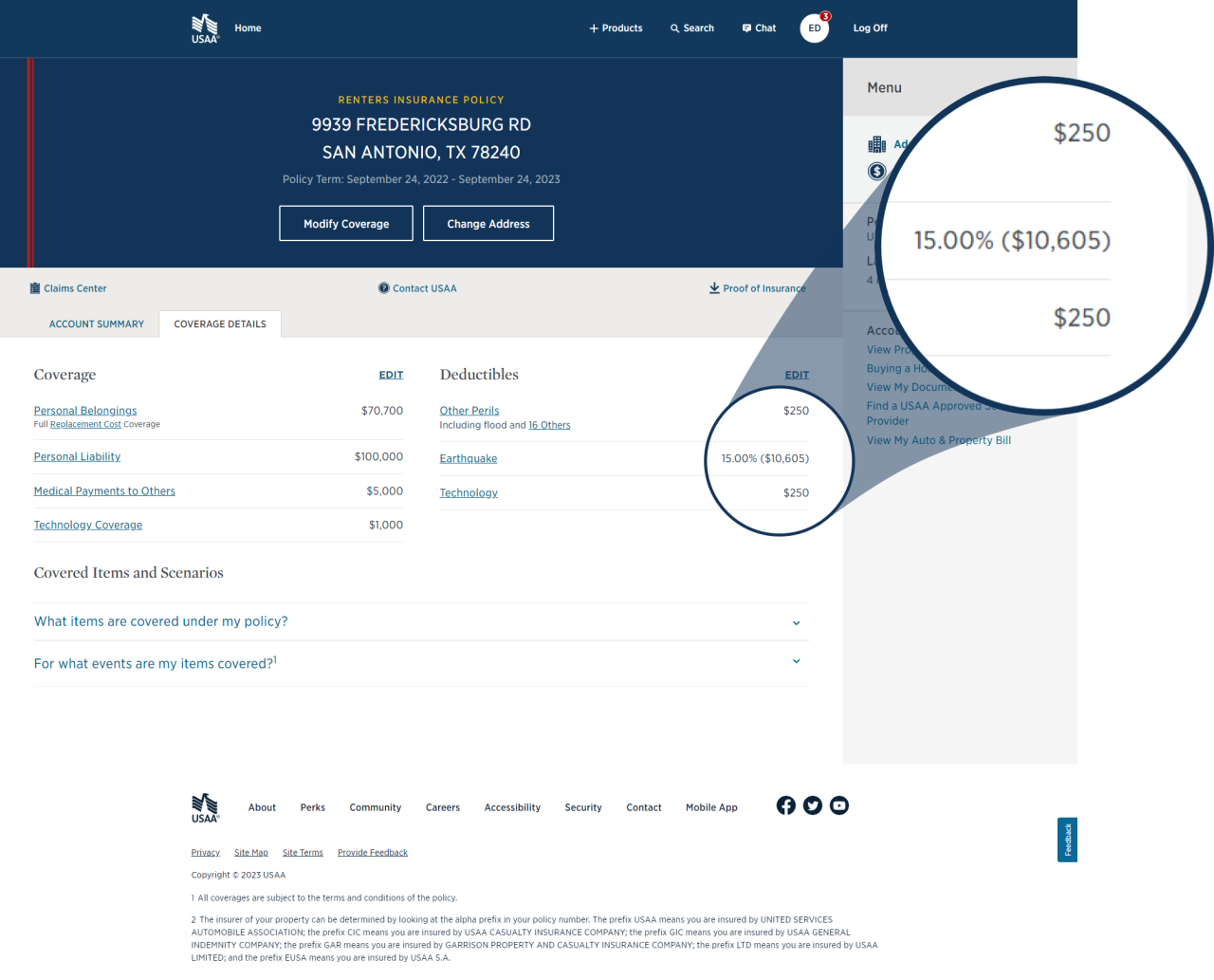

USAA renters insurance offers comprehensive coverage options to meet your individual needs.

- Personal Property Coverage: This covers your belongings, such as furniture, electronics, clothing, and personal items, against covered perils. The amount of coverage you choose should reflect the value of your possessions. You can often purchase additional coverage for specific items like jewelry or artwork.

- Liability Coverage: This protects you from financial losses if someone is injured on your property or if you are held liable for property damage caused by you or a member of your household. The standard liability coverage is typically $100,000, but you can increase it to meet your specific needs.

- Additional Living Expenses: This coverage helps pay for temporary housing and other essential expenses if your rental property becomes uninhabitable due to a covered peril. This coverage can help you maintain your lifestyle while your home is being repaired or rebuilt.

Advantages of Choosing USAA Renters Insurance

- Competitive Pricing: USAA is known for its competitive rates, which can save you money compared to other insurance providers.

- Excellent Customer Service: USAA is consistently ranked highly for its customer service. You can expect prompt and helpful assistance from their dedicated team.

- Discounts and Benefits: USAA offers a variety of discounts, including multi-policy discounts, safety discounts, and discounts for military members.

- Strong Financial Stability: USAA is a financially sound company with a long history of providing reliable insurance products.

Contacting USAA for Renters Insurance

USAA provides various methods to connect with their customer service team regarding renters insurance inquiries. Whether you need to get a quote, file a claim, or simply have a question, you can choose the most convenient way to reach them.

Contacting USAA for Renters Insurance

USAA offers multiple ways to reach out for renters insurance inquiries, including phone, email, and online chat.

Phone

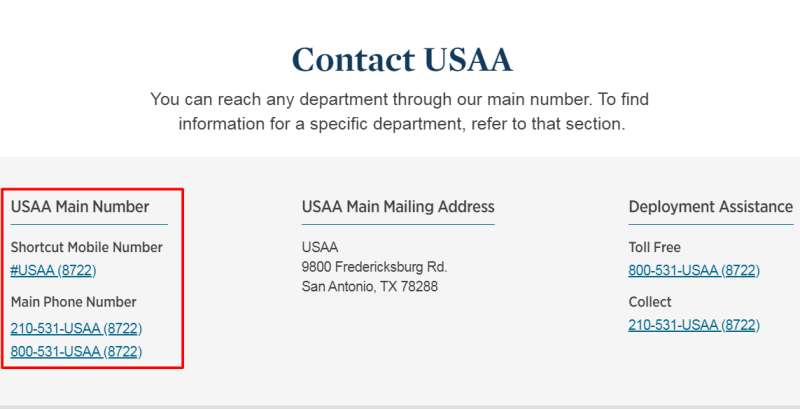

USAA has dedicated phone lines for renters insurance inquiries and general customer support.

- Renters Insurance Inquiries: You can reach USAA’s dedicated renters insurance line at 1-800-531-USAA (8722). This line is specifically for renters insurance-related questions, such as getting a quote, understanding coverage options, or reporting a claim.

- General Customer Support: For any other inquiries or issues, you can call USAA’s general customer support line at 1-800-531-USAA (8722). This line handles a wider range of topics, including account management, billing, and other general questions.

While USAA doesn’t explicitly mention an email address for renters insurance inquiries, you can reach out to their general customer support email address for any questions or concerns.

- General Customer Support Email: You can send an email to customerservice@usaa.com.

Online Chat

USAA offers an online chat feature on their website for quick and convenient communication. This is a good option for getting answers to general questions or resolving simple issues.

- Online Chat: You can access the online chat feature on the USAA website by clicking on the “Contact Us” link. The online chat feature is available 24/7, but response times may vary depending on the time of day and volume of inquiries.

Contact Information Summary

| Contact Method | Phone Number | Hours of Operation |

|---|---|---|

| Renters Insurance Inquiries | 1-800-531-USAA (8722) | 24/7 |

| General Customer Support | 1-800-531-USAA (8722) | 24/7 |

| customerservice@usaa.com | 24/7 | |

| Online Chat | N/A | 24/7 |

Obtaining a Quote and Applying for Coverage

Getting a quote for USAA renters insurance is a straightforward process that can be completed online or over the phone. You’ll need to provide some basic information about yourself and your rental property, and USAA will generate a personalized quote based on your individual needs.

Getting a Quote

To obtain a quote, you can visit USAA’s website or call their customer service line.

- Online: Navigate to USAA’s website and click on the “Renters Insurance” tab. You’ll be prompted to enter your zip code and other relevant details, such as the address of your rental property, the estimated value of your belongings, and your desired coverage levels. USAA’s website provides a user-friendly interface that guides you through the process step-by-step.

- Over the Phone: Call USAA’s customer service line at [Phone Number]. A representative will ask you for the necessary information to generate a personalized quote. This method allows for direct interaction with a USAA representative, addressing any questions or concerns you may have about the coverage options.

Applying for Coverage

Once you’ve received a quote and decided to proceed with coverage, you can apply for USAA renters insurance online or over the phone.

- Online: After obtaining a quote, you can usually apply for coverage directly on USAA’s website. This involves providing additional information about your personal details, rental property, and desired coverage levels. You can also choose your preferred payment method and review the policy details before finalizing your application.

- Over the Phone: Contact USAA’s customer service line and inform them of your decision to proceed with coverage. A representative will guide you through the application process, collecting the necessary information and assisting with any questions you may have. This method allows for a more personalized approach and immediate support during the application process.

Tips for Getting the Best Rate

- Compare Quotes: Before committing to USAA, it’s advisable to compare quotes from other insurance providers. This allows you to evaluate different coverage options and premiums, ensuring you’re getting the best value for your needs.

- Bundle Policies: If you’re also insured with USAA for other types of insurance, such as auto or homeowners, consider bundling your policies. USAA often offers discounts for multiple policies, potentially reducing your overall premiums.

- Increase Deductible: Increasing your deductible can lower your premium. However, ensure you can comfortably afford the deductible in case of a claim.

- Improve Security: Implementing security measures at your rental property, such as installing smoke detectors or burglar alarms, can qualify you for discounts from USAA.

Filing a Claim with USAA

Filing a claim for renters insurance with USAA is a straightforward process designed to help you recover from covered losses. USAA strives to make the process as smooth as possible, and they have multiple ways to file a claim, making it convenient for policyholders.

Reporting a Claim

You can report a claim with USAA through several methods:

- Online: USAA offers a user-friendly online portal for reporting claims, accessible through their website. You can submit your claim information and upload supporting documentation directly through the portal, making it a quick and efficient option.

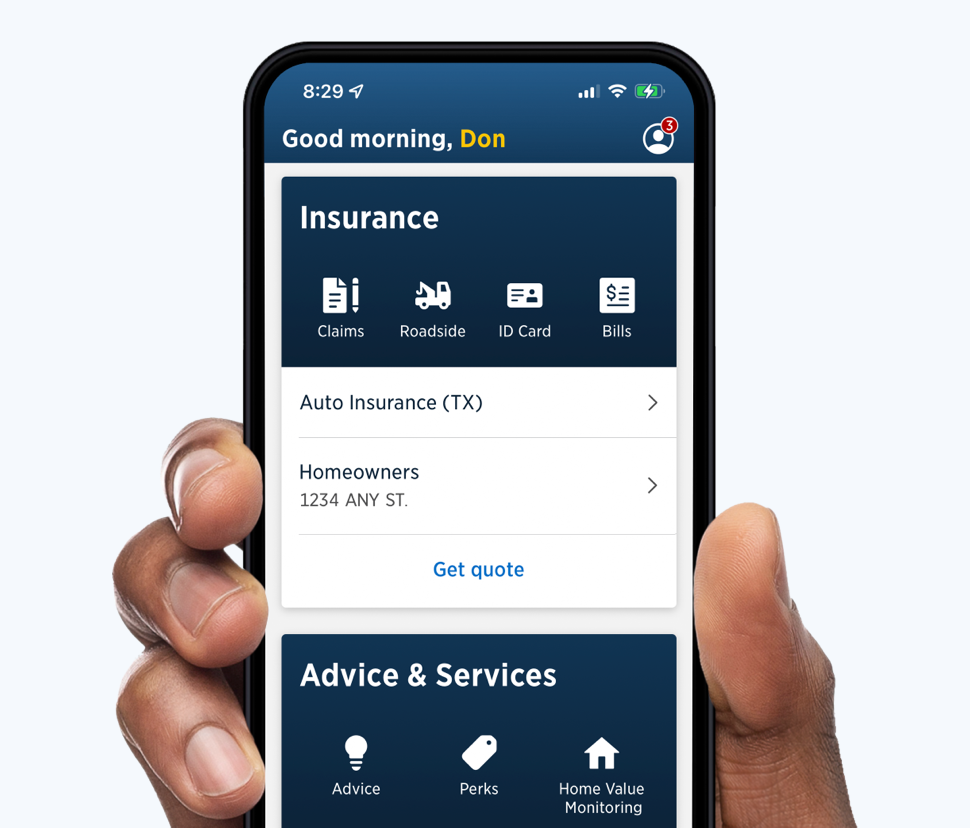

- Mobile App: The USAA mobile app provides a convenient way to file a claim on the go. You can report a claim, track its progress, and communicate with USAA representatives through the app, making it a versatile tool for managing your insurance needs.

- Phone: You can call USAA’s 24/7 customer service line to report a claim. This option is particularly useful for urgent situations or if you prefer to speak with a representative directly.

Gathering Necessary Documentation

When filing a claim, it’s crucial to have the following information readily available:

- Policy Number: This number is essential for identifying your policy and accessing your coverage details.

- Date and Time of the Incident: Providing the exact date and time of the event that caused the damage is critical for accurately documenting the claim.

- Details of the Incident: Describe the incident as thoroughly as possible, including the nature of the damage, the cause, and any contributing factors.

- Contact Information: Ensure your contact information is up-to-date and easily accessible to USAA representatives.

- Photos and Videos: Take clear photographs and videos of the damaged property, including the surrounding area. This visual documentation helps USAA assess the extent of the damage and expedite the claim process.

- Receipts and Inventory: If possible, gather receipts for any items that were damaged or lost. Additionally, create an inventory list detailing the items, their value, and their condition.

Claim Review Process

Once you’ve reported your claim, USAA will begin the review process:

- Initial Assessment: USAA will review the information you provided and may request additional documentation or information.

- Damage Inspection: A USAA adjuster may be assigned to inspect the damaged property. The adjuster will assess the extent of the damage and determine the cost of repairs or replacements.

- Claim Settlement: Based on the assessment and your coverage, USAA will determine the amount of compensation you are eligible to receive.

Timeline for Receiving Compensation

The time it takes to receive compensation for your claim depends on several factors, including the complexity of the claim, the availability of necessary information, and the time required for repairs or replacements. USAA aims to process claims efficiently and fairly, but the timeline can vary. It’s essential to keep in mind that communication with USAA representatives is crucial for staying informed about the progress of your claim.

USAA Renters Insurance Policies and Exclusions

USAA renters insurance policies provide financial protection for your belongings against covered perils, such as fire, theft, and vandalism. However, like most insurance policies, there are limitations and exclusions that define what is and isn’t covered. Understanding these limitations is crucial to ensure you have adequate coverage for your needs.

Common Exclusions in USAA Renters Insurance Policies

These exclusions are common in most renters insurance policies, including those offered by USAA.

- Earthquakes and Floods: These natural disasters are typically excluded from standard renters insurance policies. You may need to purchase separate endorsements for earthquake or flood coverage.

- Acts of War or Terrorism: Damage caused by acts of war or terrorism is usually not covered by renters insurance.

- Neglect or Intentional Acts: Coverage is generally excluded for damage caused by negligence or intentional acts of the policyholder or their household members.

- Certain Types of Property: Some types of property are typically excluded from coverage, such as cash, precious metals, and collectibles. These items may require additional coverage through endorsements or specialized policies.

- Wear and Tear: Normal wear and tear on belongings is not covered by renters insurance.

Scenarios Where Renters Insurance Might Not Apply

Here are some examples of scenarios where your USAA renters insurance policy might not provide coverage:

- Theft of Belongings Left Unattended in a Public Place: If you leave your belongings unattended in a public place and they are stolen, your renters insurance may not cover the loss.

- Damage Caused by a Pet: Damage caused by your pet, such as chewing on furniture or scratching walls, may not be covered by renters insurance.

- Damage Caused by a Guest: Damage caused by a guest in your apartment, such as spilling wine on the carpet, may not be covered if you are deemed responsible for their actions.

- Damage Caused by a Roommate: Damage caused by your roommate, such as leaving the stove on and causing a fire, may not be covered if you are deemed responsible for their actions.

Understanding USAA’s Customer Service and Support

USAA is renowned for its exceptional customer service, a reputation that extends to its renters insurance offerings. This dedication to customer satisfaction is a cornerstone of USAA’s brand identity, and it’s reflected in the positive feedback from many renters insurance policyholders.

Customer Service Reputation and Feedback

USAA consistently ranks highly in customer satisfaction surveys for financial services, including renters insurance. The company’s commitment to providing personalized support and resolving issues promptly is widely recognized. Numerous online reviews and testimonials highlight the responsiveness and helpfulness of USAA’s customer service representatives.

“USAA has always been there for me, from the moment I became a member. Their customer service is top-notch, and I’ve never had a problem getting the help I need,” shared a satisfied USAA renter insurance customer on a popular review website.

Resolving Issues and Getting Assistance

USAA provides various channels for renters insurance policyholders to access support and address concerns.

- Phone Support: USAA offers 24/7 phone support, allowing policyholders to reach a representative at any time, day or night. This accessibility is crucial for handling urgent matters or seeking immediate assistance.

- Online Portal: The USAA website provides a secure online portal where policyholders can manage their renters insurance policies, file claims, and access account information. This platform offers a convenient and efficient way to interact with USAA.

- Mobile App: USAA’s mobile app allows policyholders to manage their insurance policies, file claims, and access customer support on the go. The app’s user-friendly interface and comprehensive features make it a popular choice for policyholders seeking convenient access to services.

Tips for Resolving Issues

- Gather Relevant Information: Before contacting USAA, ensure you have all necessary details, such as your policy number, claim details, and any supporting documentation. This helps expedite the resolution process.

- Be Patient and Polite: Customer service representatives are often dealing with multiple inquiries. Maintaining a respectful and patient tone can help facilitate a positive interaction and resolution.

- Escalate if Necessary: If you are unable to resolve an issue through initial contact, USAA provides escalation procedures. This ensures that your concerns are addressed by a higher-level representative.

Comparing USAA Renters Insurance with Other Providers

Choosing the right renters insurance can be a complex process, especially when considering the diverse range of providers available. Comparing features, benefits, and pricing across different companies is essential to ensure you secure the most suitable coverage for your needs and budget.

USAA Renters Insurance vs. Other Leading Providers

To provide a comprehensive comparison, we’ve compiled a table that Artikels key features, pricing, and customer service ratings for USAA and other prominent renters insurance providers.

| Provider | Coverage Options | Pricing | Customer Service Ratings |

|---|---|---|---|

| USAA | Personal property coverage, liability coverage, additional living expenses, and optional coverage for valuables. | Competitive pricing, discounts for bundling with other insurance policies. | High ratings from J.D. Power and other consumer organizations. |

| State Farm | Similar coverage options to USAA, including personal property, liability, and additional living expenses. | Pricing varies depending on location and coverage level. | Generally positive customer service ratings, with some variability depending on location and individual experiences. |

| Allstate | Offers comprehensive coverage options, including personal property, liability, and additional living expenses. | Pricing can be competitive, but may vary significantly based on factors such as location and coverage level. | Customer service ratings vary, with some reports of inconsistent experiences. |

| Liberty Mutual | Provides a wide range of coverage options, including personal property, liability, and additional living expenses. | Pricing is generally competitive, with discounts available for bundling policies. | Customer service ratings are generally positive, with a focus on responsiveness and helpfulness. |

Key Differentiators and Considerations

- Membership Requirements: USAA is a member-owned organization, meaning you must be a member of the USAA family (active military, veterans, or their families) to qualify for their insurance products.

- Discounts and Bundling: USAA often offers discounts for bundling renters insurance with other policies, such as auto insurance. Other providers also offer discounts, but the specific criteria and availability may vary.

- Customer Service: USAA consistently receives high marks for its customer service, known for its responsiveness and personalized attention. However, other providers also have dedicated customer service teams and may offer online resources or mobile apps for convenient support.

- Claims Process: Each provider has its own claims process. USAA is known for its efficient and streamlined process, with dedicated claims representatives and online tools for reporting claims.

USAA’s Strengths and Weaknesses

- Strengths:

- Competitive pricing, especially for members.

- Excellent customer service and reputation.

- Wide range of coverage options.

- Streamlined claims process.

- Weaknesses:

- Membership restrictions limit eligibility.

- May not offer the most comprehensive coverage options compared to some competitors.

Factors to Consider When Choosing Renters Insurance

Choosing the right renters insurance policy can provide peace of mind and financial protection in case of unexpected events. It’s important to carefully consider your individual needs and circumstances to make an informed decision.

Coverage Needs

Determining the right amount of coverage is crucial. Consider the value of your belongings, including furniture, electronics, clothing, and personal items. Factor in the cost of replacement or repair, accounting for inflation. Additionally, consider the following:

- Personal liability coverage: This protects you from lawsuits if someone is injured on your property. The standard amount is typically $100,000, but you may need more depending on your lifestyle and potential risks.

- Additional living expenses: This covers temporary housing, food, and other essential expenses if you’re displaced from your home due to a covered event. It’s essential if you need to stay in a hotel or temporary residence.

- Valuables coverage: If you have expensive items like jewelry, artwork, or collectibles, consider adding a rider or endorsement to your policy for extra coverage. This ensures these items are adequately protected.

Budget

Renters insurance premiums vary based on factors like coverage amounts, location, and the insurer’s pricing structure. It’s essential to balance coverage needs with affordability.

- Compare quotes: Get quotes from multiple insurers to compare prices and coverage options. Online comparison tools can streamline this process.

- Consider deductibles: A higher deductible generally leads to lower premiums. Choose a deductible you can comfortably afford in case of a claim.

- Bundle policies: If you have other insurance policies with the same insurer, you may qualify for discounts by bundling your renters insurance with auto or home insurance.

Personal Preferences

Your personal preferences play a role in choosing the right policy.

- Customer service: Consider the insurer’s reputation for customer service, responsiveness, and claim handling. Read reviews and testimonials to gauge their performance.

- Digital tools and resources: Look for insurers that offer convenient online platforms, mobile apps, and 24/7 customer support. This can make managing your policy and filing claims easier.

- Discounts: Explore potential discounts offered by insurers, such as those for safety features, security systems, or being a long-time customer. These can help you save money on your premiums.

Resources and Tools

Several resources can help you compare and evaluate different renters insurance options.

- Insurance comparison websites: Websites like Policygenius, NerdWallet, and Insurify allow you to compare quotes from multiple insurers side-by-side. This can save you time and effort.

- Consumer reports: Organizations like Consumer Reports and J.D. Power provide ratings and reviews of insurance companies based on customer satisfaction and claim handling. These reports can offer valuable insights.

- Financial advisors: A financial advisor can provide personalized guidance and recommendations based on your specific needs and financial situation.

Tips for Protecting Your Belongings as a Renter

As a renter, you’re responsible for safeguarding your belongings, and proactive measures can significantly reduce the risk of loss or damage. By implementing smart security practices and maintaining a detailed inventory, you can enhance your peace of mind and protect your valuable possessions.

Creating an Inventory of Your Possessions

A detailed inventory serves as a crucial record of your belongings, aiding in insurance claims and providing a comprehensive overview of your assets.

- Take detailed photographs or videos of each item, capturing its condition and any identifying marks.

- Document the purchase date, price, and any serial numbers for each item. This information is essential for insurance claims.

- Organize your inventory by room or category for easy reference and retrieval.

- Store your inventory securely in a safe place outside your apartment, such as a safety deposit box or with a trusted friend or family member.

Implementing Security Measures

Strengthening security measures within your apartment can deter potential theft and protect your belongings.

- Install a reliable deadbolt lock on all exterior doors, ensuring they meet security standards.

- Use a peephole to identify visitors before opening the door.

- Consider installing a home security system, including motion detectors and alarms, for enhanced protection.

- Never leave valuables in plain sight, particularly when you’re away from home. Store them securely in a safe or lockbox.

- Be cautious about sharing personal information online or through social media, as it could be used by criminals to target your home.

Minimizing the Risk of Damage

Preventative measures can significantly reduce the risk of damage to your belongings.

- Regularly inspect and maintain appliances, such as your refrigerator, oven, and washing machine, to prevent malfunctions and potential damage.

- Use smoke detectors and carbon monoxide detectors, ensuring they are functional and regularly tested.

- Avoid overloading electrical outlets, as this can lead to overheating and potential fires.

- Keep flammable materials, such as paint thinner or gasoline, stored safely and away from heat sources.

- Protect your belongings from water damage by ensuring that pipes and fixtures are properly sealed and maintained.

Epilogue

From obtaining quotes and applying for coverage to filing claims and receiving support, USAA’s commitment to customer service shines through their readily accessible phone lines. By understanding how to utilize these resources effectively, USAA members can rest assured knowing that their renters insurance needs are met with promptness and expertise. Remember, a simple phone call can be the key to unlocking the peace of mind that comes with comprehensive renters insurance protection.