Auto insurance premiums are a significant expense for most drivers, and understanding the factors that influence their cost is crucial for making informed financial decisions. From your driving history to the make and model of your vehicle, numerous elements play a role in determining how much you pay for insurance. This guide delves into the intricate world of auto insurance premiums, providing insights into the key factors that impact rates, strategies for maximizing savings, and essential tips for navigating the claims process.

Whether you’re a seasoned driver or a first-time policyholder, this comprehensive resource will empower you with the knowledge to secure the most suitable and affordable auto insurance coverage.

Understanding Auto Insurance Premiums

Auto insurance premiums are the monthly or annual payments you make to your insurance company in exchange for coverage against financial losses resulting from car accidents or other covered events. Understanding how these premiums are calculated is crucial for making informed decisions about your insurance policy and potentially saving money.

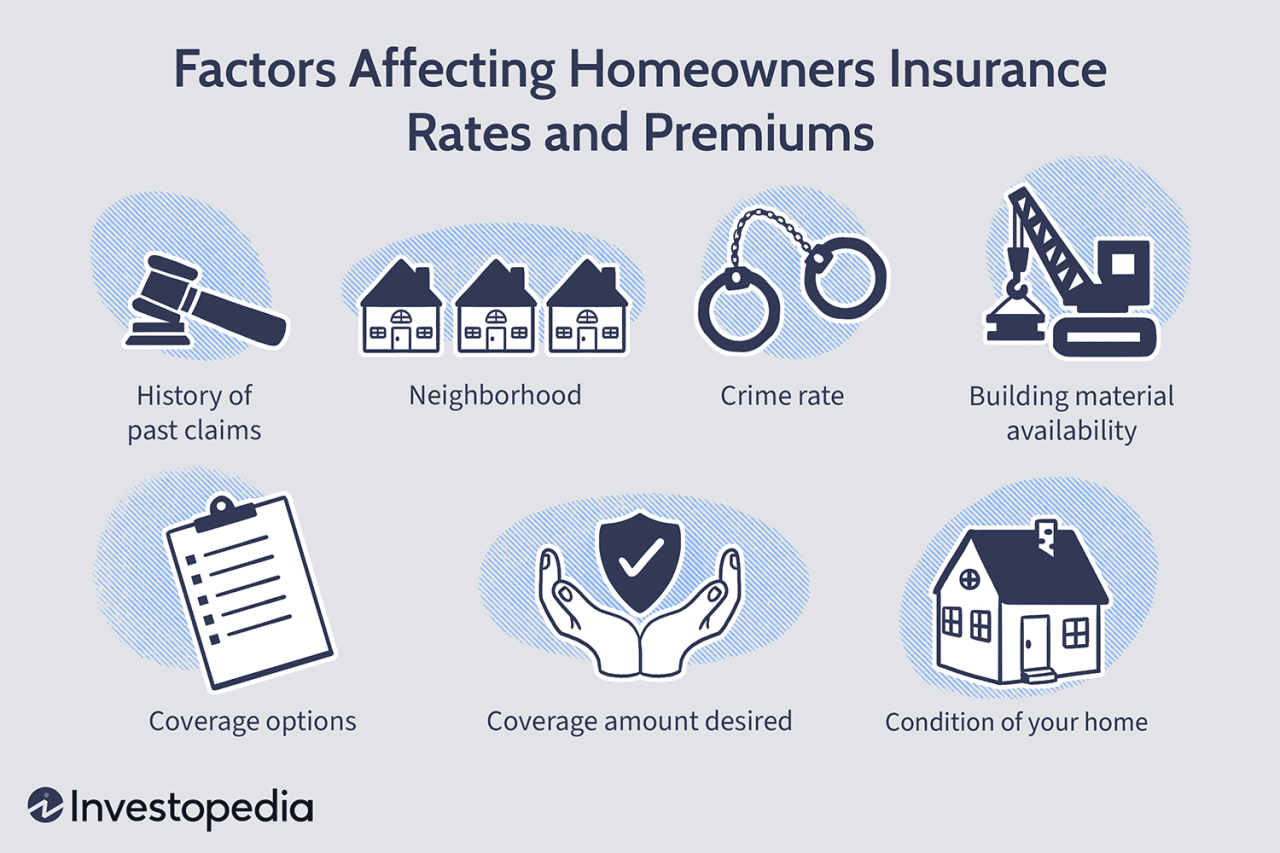

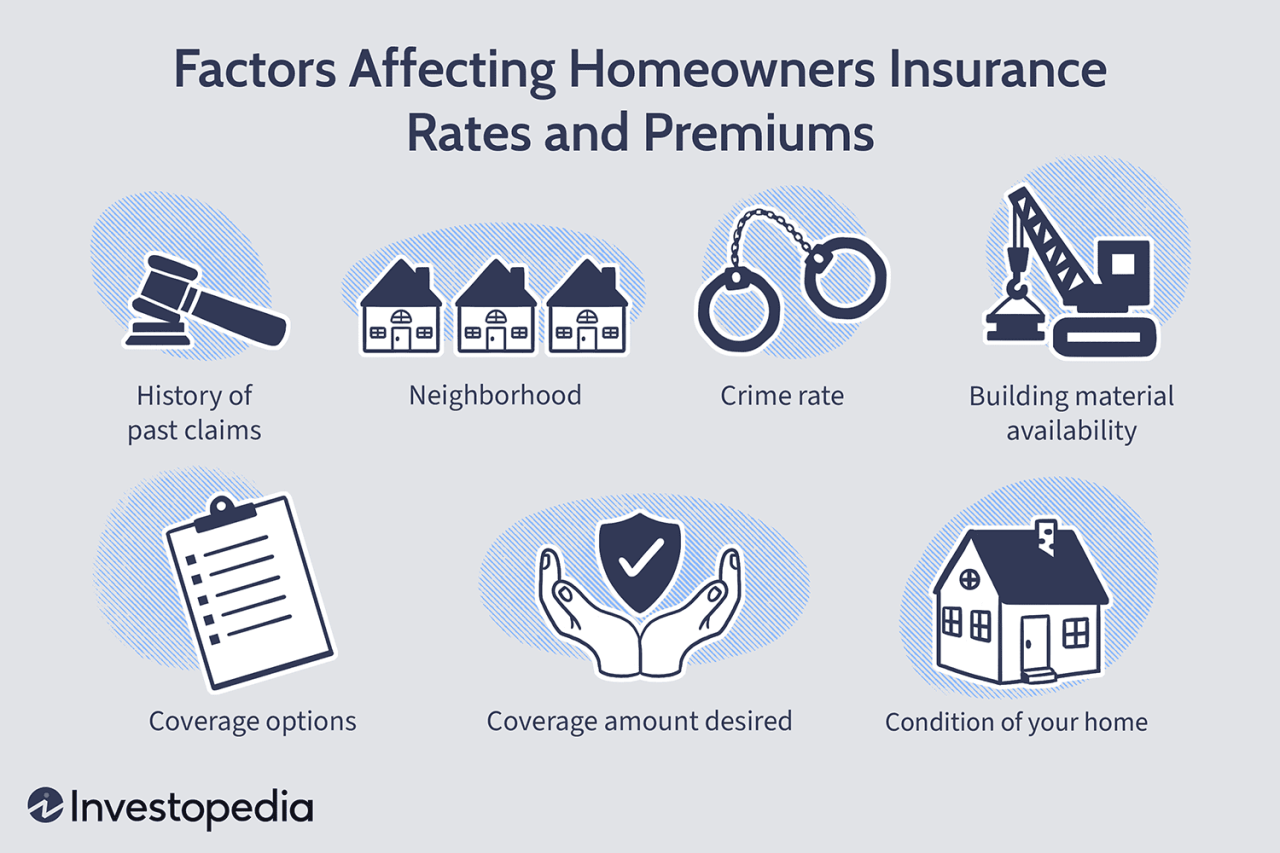

Factors Determining Auto Insurance Premiums

Numerous factors contribute to the cost of your auto insurance premium. These factors are categorized into individual, vehicle, and location-related aspects.

- Individual factors: These include your age, driving history, credit score, and even your occupation. Younger drivers, those with a history of accidents or violations, and those with poor credit scores generally pay higher premiums.

- Vehicle factors: The type of vehicle you drive, its safety features, and its value play a significant role. Luxury cars, sports cars, and vehicles with high repair costs tend to have higher premiums.

- Location factors: Your address, the density of traffic in your area, and the frequency of accidents in your region also impact premiums. Areas with higher traffic volume and more accidents generally have higher insurance rates.

Components of an Auto Insurance Premium

Your auto insurance premium is comprised of various components, each contributing to the overall cost.

- Coverage: The types of coverage you choose, such as liability, collision, comprehensive, and uninsured motorist coverage, directly affect your premium. More extensive coverage typically translates to higher premiums.

- Deductibles: Your deductible is the amount you pay out-of-pocket before your insurance kicks in. A higher deductible generally means a lower premium, as you’re taking on more financial risk.

- Liability limits: Liability limits determine the maximum amount your insurance company will pay for damages caused by an accident. Higher liability limits provide greater protection but come with higher premiums.

Impact of Different Factors on Premiums

The impact of various factors on your auto insurance premium can be illustrated with real-world examples.

- Age: A 20-year-old driver with a clean driving record might pay significantly higher premiums compared to a 40-year-old driver with similar driving history. This difference reflects the higher risk associated with younger drivers.

- Driving history: A driver with multiple speeding tickets or accidents will likely face higher premiums compared to a driver with a spotless record. Insurance companies assess risk based on past driving behavior.

- Vehicle type: A high-performance sports car with advanced safety features will generally have a higher premium than a basic sedan. The risk of accidents and the cost of repairs are factors considered in premium calculations.

Factors Influencing Premium Rates

Auto insurance premiums are not one-size-fits-all. Insurance companies use a complex system of factors to determine the cost of your policy. These factors are designed to assess the risk you pose to the insurer, ultimately impacting the price you pay.

Driving Habits

Your driving habits significantly influence your auto insurance premium. Insurance companies analyze your driving history to understand your risk profile.

- Mileage: The more you drive, the greater the chance of an accident. Higher mileage translates to a higher premium.

- Driving History: A clean driving record with no accidents or traffic violations leads to lower premiums. Conversely, a history of accidents, speeding tickets, or other violations increases your risk profile, resulting in higher premiums.

- Traffic Violations: Each traffic violation, like speeding tickets or reckless driving, signals a higher risk of future accidents. Insurance companies factor in these violations to calculate your premium.

Vehicle Characteristics

The type of vehicle you drive also influences your premium. Insurance companies consider several aspects of your vehicle:

- Make and Model: Certain makes and models are statistically associated with a higher risk of accidents or theft. For instance, sports cars are often associated with higher accident rates, leading to higher premiums.

- Year: Newer vehicles typically have more advanced safety features, which can lead to lower premiums. Conversely, older vehicles may lack modern safety features, increasing your risk and potentially leading to higher premiums.

- Safety Features: Vehicles equipped with safety features like anti-lock brakes, airbags, and stability control are generally considered safer. These features can lead to lower premiums, as they reduce the likelihood of accidents and severity of injuries.

Discounts and Savings

Auto insurance premiums can vary significantly depending on various factors, but one way to potentially lower your costs is by taking advantage of available discounts. These discounts are offered by insurance companies to incentivize safe driving practices, responsible ownership, and customer loyalty.

Common Discounts

Discounts can be a significant way to save on your auto insurance premiums. Here are some of the most common discounts available:

- Good Driver Discount: This is one of the most common discounts, awarded to drivers with a clean driving record, free of accidents and traffic violations. This discount can be substantial, often ranging from 10% to 25% or more, depending on the insurer and the driver’s specific history.

- Safe Driver Discount: Similar to the good driver discount, this discount is offered to drivers who demonstrate safe driving habits. This might involve taking defensive driving courses, having a telematics device installed in their car, or participating in other safety programs.

- Multi-Car Discount: Insurers often offer discounts for insuring multiple vehicles with the same company. This can be a significant savings, as the insurer can bundle your policies and reduce administrative costs.

- Multi-Policy Discount: You can often get a discount for bundling your auto insurance with other types of insurance, such as homeowners, renters, or life insurance. This is similar to the multi-car discount, where the insurer benefits from bundling policies and reducing administrative costs.

- Good Student Discount: Many insurers offer discounts to students who maintain a certain GPA or are enrolled in a college or university. This discount is often available to young drivers, recognizing their responsible academic pursuits.

- Anti-theft Device Discount: If your car has anti-theft devices, such as an alarm system or immobilizer, you may qualify for a discount. These devices deter theft, which reduces the insurer’s risk and allows them to offer lower premiums.

- Loyalty Discount: Some insurance companies reward long-term customers with discounts for their continued business. This loyalty discount can be a significant incentive for staying with the same insurer over time.

Qualifying for Discounts

To qualify for discounts, you typically need to provide your insurer with specific documentation or information. Here are some examples:

- Good Driving Record: To qualify for a good driver discount, you’ll need to provide your insurer with a copy of your driving record, which can be obtained from your state’s Department of Motor Vehicles. This record will show any accidents, violations, or other incidents that may affect your premium.

- Safety Features: To qualify for a discount based on safety features, you’ll need to provide your insurer with information about your car’s equipment, such as airbags, anti-lock brakes, and stability control. This information can be found in your car’s owner’s manual or on the vehicle’s sticker.

- Bundling Insurance Policies: To qualify for a multi-policy discount, you’ll need to provide your insurer with information about your other insurance policies. This information can be found on your existing insurance policies or by contacting your current insurers.

Maximizing Savings

To maximize savings on your auto insurance premiums, consider these strategies:

- Shop Around: Don’t settle for the first quote you receive. Get quotes from multiple insurers to compare rates and find the best deal.

- Ask About Discounts: Be proactive in asking your insurer about all available discounts. Don’t assume they’ll automatically apply them. You may need to provide documentation or information to qualify.

- Improve Your Driving Record: Maintain a clean driving record by avoiding accidents and traffic violations. This will qualify you for lower premiums and potentially save you money over time.

- Consider Safety Features: When purchasing a new car, consider models with advanced safety features, such as airbags, anti-lock brakes, and stability control. These features can reduce your insurance costs and potentially improve your safety on the road.

- Bundle Your Policies: Consider bundling your auto insurance with other types of insurance, such as homeowners, renters, or life insurance. This can result in significant savings due to multi-policy discounts.

Types of Auto Insurance Coverage

Auto insurance is a crucial financial safety net for drivers, protecting them from significant financial burdens in the event of an accident or other unforeseen circumstances. Understanding the different types of coverage available is essential for making informed decisions about your insurance needs and ensuring you have adequate protection.

Liability Coverage

Liability coverage is the most basic and legally required type of auto insurance in most states. It protects you financially if you are at fault in an accident that causes injury or damage to another person or property. Liability coverage is typically divided into two parts: bodily injury liability and property damage liability.

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages incurred by the other party due to your negligence. It is typically expressed as a limit per person and a limit per accident, for example, $100,000 per person/$300,000 per accident.

- Property Damage Liability: This coverage pays for repairs or replacement of the other party’s vehicle or property that was damaged in an accident due to your negligence. It is typically expressed as a single limit, such as $50,000.

For example, if you cause an accident that results in $50,000 in damage to the other driver’s vehicle and $20,000 in medical expenses for the other driver, your liability coverage will pay up to $50,000 for property damage and up to $100,000 for bodily injury, depending on your policy limits.

Collision Coverage

Collision coverage pays for repairs or replacement of your own vehicle if it is damaged in an accident, regardless of who is at fault. This coverage is optional but is highly recommended for newer or financed vehicles.

For example, if you are involved in an accident and your vehicle is totaled, collision coverage will pay the actual cash value of your vehicle, minus your deductible.

Comprehensive Coverage

Comprehensive coverage protects your vehicle against damage caused by events other than accidents, such as theft, vandalism, fire, hail, or natural disasters. It is also optional, but it is a good idea to consider it for newer vehicles or vehicles with high value.

For example, if your car is stolen or damaged by a hailstorm, comprehensive coverage will pay for repairs or replacement, minus your deductible.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage protects you and your passengers if you are involved in an accident with a driver who has no insurance or insufficient insurance. It covers medical expenses, lost wages, and other damages incurred due to the other driver’s negligence.

For example, if you are hit by an uninsured driver and suffer significant injuries, uninsured motorist coverage will pay for your medical expenses and other damages up to your policy limits.

Shopping for Auto Insurance

Finding the best auto insurance policy for your needs can feel like a daunting task, but it doesn’t have to be. With a little research and planning, you can secure a policy that offers the right coverage at a competitive price. This section will guide you through the process of shopping for auto insurance and making informed decisions.

Comparing Quotes from Different Providers

Getting multiple quotes from different insurance providers is essential for finding the best deal. You can use online comparison websites, contact insurance agents directly, or work with a broker who can compare quotes from various companies.

Here are some steps to guide you through the process:

- Gather your information: Before you start comparing quotes, make sure you have all the necessary information, including your driver’s license, vehicle information (make, model, year), and driving history.

- Use online comparison websites: These websites allow you to enter your information and compare quotes from multiple insurers simultaneously. They can save you time and effort, but it’s important to note that they may not always include all insurers in their comparisons.

- Contact insurance agents directly: You can also contact insurance agents directly to get quotes. This allows you to ask questions and get personalized recommendations.

- Work with a broker: An insurance broker can compare quotes from multiple insurers on your behalf. They can provide expert advice and help you find the best policy for your needs.

Considering Factors When Choosing a Policy

Once you have received several quotes, it’s time to carefully evaluate each policy. Consider the following factors:

- Coverage: Make sure the policy provides the coverage you need, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

- Deductibles: A deductible is the amount you pay out of pocket before your insurance kicks in. Higher deductibles typically result in lower premiums, but you’ll have to pay more if you need to file a claim.

- Customer service: Consider the insurer’s reputation for customer service. Look for companies with positive reviews and a track record of handling claims efficiently.

- Financial stability: Choose an insurer with a strong financial rating. This indicates the company is financially sound and able to pay claims in the event of a major accident.

Negotiating Lower Premiums

You may be able to negotiate lower premiums by:

- Bundling policies: If you have other insurance policies, such as homeowners or renters insurance, you can often get a discount by bundling them with your auto insurance.

- Improving your driving record: Maintaining a clean driving record is one of the best ways to reduce your premiums. Avoid speeding tickets, accidents, and other traffic violations.

- Installing safety features: Installing safety features in your vehicle, such as anti-theft devices or airbags, can qualify you for discounts.

- Taking a defensive driving course: Completing a defensive driving course can demonstrate your commitment to safe driving and may earn you a discount.

- Shopping around regularly: It’s a good idea to compare quotes from different insurers every year or two, as rates can fluctuate.

Obtaining the Best Possible Coverage

- Review your policy: It’s essential to carefully review your policy to ensure you understand the coverage you’re getting and any limitations.

- Ask questions: Don’t hesitate to ask your insurance agent or broker any questions you have about your policy.

- Consider additional coverage: Depending on your individual needs, you may want to consider additional coverage options, such as roadside assistance or rental car reimbursement.

Managing Auto Insurance Costs

Auto insurance premiums are a significant expense for most drivers. However, there are strategies you can employ to effectively manage these costs and potentially save money on your premiums. By understanding the factors that influence premium rates and taking proactive steps to minimize your risk, you can keep your insurance costs in check.

Driving Habits and Premium Rates

Your driving habits have a direct impact on your auto insurance premiums. Insurers assess your risk based on factors such as your driving history, the number of miles you drive, and your driving behavior. Safe driving practices, such as avoiding speeding and distracted driving, can significantly reduce your premiums.

- Speeding: Speeding tickets not only increase your insurance premiums but also carry hefty fines and potential license suspension. Avoiding speeding significantly reduces your risk of accidents and helps maintain a clean driving record.

- Distracted Driving: Distracted driving, such as texting, talking on the phone, or eating while driving, significantly increases the risk of accidents. Insurers recognize the danger of distracted driving and may charge higher premiums to drivers who engage in these risky behaviors.

Auto Insurance Claims

Filing an auto insurance claim is a necessary process when you’re involved in an accident. It’s designed to help you recover financially from damages and injuries. Understanding the process can make the experience smoother and more efficient.

Filing an Auto Insurance Claim

The process of filing an auto insurance claim typically involves several steps:

- Contact your insurance company: The first step is to contact your insurance company as soon as possible after the accident. You can usually do this by phone or online. Be prepared to provide details about the accident, including the date, time, location, and any injuries involved.

- File a claim: Your insurance company will provide you with a claim form to complete. This form will ask for details about the accident, your vehicle, and any damages.

- Provide documentation: You’ll need to provide supporting documentation for your claim, such as a police report, photos of the damage, and medical bills.

- Get your vehicle inspected: Your insurance company may require you to have your vehicle inspected by an appraiser to assess the damage.

- Negotiate a settlement: Once your claim is reviewed, your insurance company will offer you a settlement. You have the right to negotiate this settlement if you feel it’s too low.

Reporting an Accident

Reporting an accident to your insurance company is crucial. This initiates the claims process and ensures that your coverage is activated.

- Gather information: Immediately after the accident, gather as much information as possible. This includes the names and contact information of all parties involved, the license plate numbers of all vehicles, and any witness information.

- Document the accident: Take photos of the damage to all vehicles involved, the accident scene, and any injuries.

- Contact the police: If there are injuries or significant property damage, contact the police to report the accident.

- Contact your insurance company: Once you have gathered all the necessary information, contact your insurance company to report the accident.

Dealing with the Insurance Company

Dealing with your insurance company after an accident can be stressful. However, it’s important to remain calm and cooperative.

- Be truthful and accurate: When providing information to your insurance company, be truthful and accurate. Any inconsistencies or inaccuracies could jeopardize your claim.

- Keep detailed records: Keep detailed records of all communications with your insurance company, including dates, times, and summaries of conversations.

- Don’t rush into a settlement: Don’t feel pressured to accept a settlement offer immediately. Take your time to review the offer and make sure it’s fair.

- Consult with an attorney: If you’re having difficulty dealing with your insurance company or feel that your claim is being unfairly handled, consider consulting with an attorney.

Tips for a Smooth Claims Experience

Following these tips can help ensure a smooth and successful claims experience:

- Know your policy: Before an accident occurs, carefully review your auto insurance policy to understand your coverage and limits.

- Keep your policy information handy: Keep your insurance policy information in a safe and accessible place. This includes your policy number, contact information, and coverage details.

- Report accidents promptly: Report any accidents to your insurance company as soon as possible.

- Cooperate with your insurance company: Be cooperative with your insurance company and provide them with the information they need to process your claim.

- Be patient: The claims process can take time. Be patient and understanding with your insurance company.

Auto Insurance Trends

The auto insurance industry is undergoing a period of rapid transformation, driven by technological advancements and changing consumer expectations. These shifts are leading to innovative products, evolving pricing models, and a more personalized approach to risk assessment.

Telematics and Usage-Based Insurance

Telematics refers to the use of technology to collect data on driving behavior. This data can include speed, braking patterns, mileage, and time of day driving. Usage-based insurance (UBI) programs leverage telematics data to personalize premium rates based on individual driving habits.

- Lower Premiums for Safe Drivers: UBI programs typically offer lower premiums to drivers who demonstrate safe driving behavior, rewarding them for their responsible actions. For example, a driver who consistently maintains a safe speed and avoids harsh braking could receive a significant discount on their insurance premium.

- Increased Transparency and Control: Telematics provides drivers with insights into their own driving habits, empowering them to make adjustments and improve their safety. This transparency can lead to a greater sense of control over their insurance costs.

- Data-Driven Risk Assessment: By analyzing driving data, insurers can more accurately assess individual risk profiles. This enables them to offer more tailored and equitable premiums, reflecting the actual driving behavior of each policyholder.

Impact of Technology on Premiums and Coverage

Technological advancements are influencing auto insurance premiums and coverage options in several ways:

- Advanced Safety Features: Vehicles equipped with advanced safety features, such as lane departure warning, automatic emergency braking, and adaptive cruise control, are generally considered safer and may qualify for lower premiums. Insurers are recognizing the positive impact of these technologies on reducing accidents and claims.

- Artificial Intelligence (AI) and Machine Learning: AI and machine learning algorithms are being used to analyze vast amounts of data, including driving records, claims history, and even weather patterns, to refine risk assessment models and improve pricing accuracy. This can lead to more competitive premiums and personalized coverage options.

- Digitalization and Automation: The increasing adoption of digital platforms and automated processes is streamlining the insurance buying experience, making it more convenient and accessible. Insurers are offering online quotes, digital policy management, and automated claims processing, enhancing customer satisfaction and efficiency.

Future of Auto Insurance

The future of auto insurance is likely to be characterized by:

- Increased Personalization: As technology advances, insurers will be able to offer increasingly personalized insurance products tailored to individual needs and driving habits. This could involve customized coverage packages, flexible payment options, and personalized risk management advice.

- Integration with Connected Cars: Connected cars equipped with advanced sensors and communication capabilities will provide insurers with real-time data on vehicle performance, driving conditions, and potential risks. This data can be used to optimize coverage, pricing, and even driver assistance services.

- Emergence of New Business Models: The rise of mobility services, such as ride-sharing and autonomous vehicles, could lead to new insurance models that address the unique risks associated with these emerging technologies. Insurers may offer coverage tailored to specific mobility services, such as ride-sharing insurance or autonomous vehicle liability insurance.

Auto Insurance and Financial Planning

Auto insurance is an essential component of personal financial planning, safeguarding individuals and families from significant financial burdens in the event of an accident or other covered incidents. It plays a crucial role in protecting assets, ensuring financial stability, and mitigating potential risks associated with vehicle ownership.

The Impact of Insurance Costs on Household Budgets

Auto insurance premiums represent a recurring expense that can significantly impact household budgets, especially for families with multiple vehicles or drivers. Understanding the factors that influence premium rates and implementing strategies to manage costs effectively is vital for maintaining financial stability.

“Auto insurance premiums can be a significant financial burden, particularly for low- and middle-income households, who may face challenges in affording adequate coverage.” – National Highway Traffic Safety Administration (NHTSA)

- High Deductibles: Choosing higher deductibles can lower monthly premiums, but this requires having sufficient savings to cover out-of-pocket expenses in case of an accident.

- Bundling Policies: Combining auto insurance with other policies like homeowners or renters insurance can often lead to discounts and lower overall premiums.

- Safe Driving Practices: Maintaining a clean driving record, avoiding traffic violations, and practicing defensive driving techniques can significantly reduce premiums over time.

Auto Insurance Regulations

Auto insurance regulations are a complex web of laws and rules that govern the insurance industry. They play a crucial role in ensuring fairness, protecting consumers, and maintaining the stability of the insurance market. These regulations are often established at the state level, with some federal oversight, and vary significantly across jurisdictions.

Government Agencies and Their Roles

Government agencies play a vital role in regulating the auto insurance industry. They are responsible for setting standards, enforcing laws, and protecting consumer interests. Here are some key agencies and their roles:

- State Insurance Departments: These departments are the primary regulators of insurance in the United States. They are responsible for licensing insurers, setting rates, overseeing claims handling, and enforcing consumer protection laws. For example, the California Department of Insurance regulates the insurance industry in the state and provides resources for consumers to understand their rights and file complaints.

- National Association of Insurance Commissioners (NAIC): This organization is a forum for state insurance regulators to collaborate and develop model laws and regulations. The NAIC’s model laws and regulations serve as a framework for state legislatures and insurance departments to adopt and implement.

- Federal Agencies: While the primary regulation of auto insurance is at the state level, some federal agencies have oversight roles. For instance, the Federal Trade Commission (FTC) enforces consumer protection laws related to unfair or deceptive practices in the insurance industry.

Impact of Regulations on Consumers

Auto insurance regulations have a significant impact on consumers. They protect consumers from unfair practices, ensure access to affordable coverage, and provide a framework for resolving disputes. Here are some key ways regulations impact consumers:

- Guaranty Funds: Most states have guaranty funds that protect consumers in the event of an insurer’s insolvency. These funds provide a safety net for policyholders, ensuring that they will receive some coverage even if their insurer goes bankrupt.

- Minimum Coverage Requirements: States mandate minimum liability insurance coverage requirements for all drivers. These requirements ensure that drivers have sufficient coverage to compensate others for injuries or property damage they may cause in an accident.

- Consumer Protection Laws: State laws protect consumers from unfair or deceptive practices by insurers. These laws address issues such as rate discrimination, unfair claims handling, and deceptive advertising.

Auto Insurance Resources

Navigating the world of auto insurance can be overwhelming, but numerous resources are available to help consumers make informed decisions and protect their interests. This section provides a comprehensive list of valuable resources, including government agencies, consumer protection organizations, and reputable websites, offering guidance on insurance matters.

Government Agencies

Government agencies play a crucial role in regulating the insurance industry and protecting consumers’ rights. They provide information, resources, and assistance to individuals seeking information about auto insurance.

- National Association of Insurance Commissioners (NAIC): The NAIC is a non-profit organization representing state insurance regulators. It develops model laws and regulations, promotes uniformity in insurance regulation, and provides consumer information on insurance topics, including auto insurance. Website: [https://www.naic.org/](https://www.naic.org/)

- Federal Trade Commission (FTC): The FTC enforces federal consumer protection laws, including those related to insurance. It provides resources and guidance on avoiding insurance scams and understanding insurance policies. Website: [https://www.ftc.gov/](https://www.ftc.gov/)

- State Insurance Departments: Each state has its own insurance department responsible for regulating insurance companies and protecting consumers within its jurisdiction. Contact your state’s insurance department for information on auto insurance laws, regulations, and consumer protection resources. You can find contact information for your state’s insurance department on the NAIC website.

Consumer Protection Organizations

Consumer protection organizations advocate for consumer rights and provide valuable information and resources to help individuals navigate insurance issues.

- Consumer Reports: Consumer Reports is a non-profit organization that conducts independent testing and research on consumer products and services, including auto insurance. It provides ratings and reviews of insurance companies, helping consumers make informed decisions. Website: [https://www.consumerreports.org/](https://www.consumerreports.org/)

- National Consumer Law Center (NCLC): The NCLC is a non-profit organization that advocates for low- and moderate-income consumers. It provides information and resources on insurance issues, including consumer rights and how to file complaints. Website: [https://www.nclc.org/](https://www.nclc.org/)

- Insurance Information Institute (III): The III is a non-profit organization that provides information and resources on insurance topics, including auto insurance. It offers consumer guides, fact sheets, and articles on various insurance-related matters. Website: [https://www.iii.org/](https://www.iii.org/)

Reputable Websites

Several reputable websites offer valuable information and resources on auto insurance.

- Insurance.com: Insurance.com is a website that allows consumers to compare insurance quotes from different companies. It provides information on various insurance topics, including auto insurance, and offers tools and resources to help consumers make informed decisions. Website: [https://www.insurance.com/](https://www.insurance.com/)

- NerdWallet: NerdWallet is a personal finance website that provides information and tools on various financial topics, including auto insurance. It offers comparisons of insurance companies, rates, and coverage options. Website: [https://www.nerdwallet.com/](https://www.nerdwallet.com/)

- Bankrate: Bankrate is a financial website that provides information and comparisons on various financial products and services, including auto insurance. It offers tools and resources to help consumers find the best insurance rates and coverage options. Website: [https://www.bankrate.com/](https://www.bankrate.com/)

Last Point

Navigating the complexities of auto insurance premiums requires a multifaceted approach. By understanding the factors that influence rates, exploring available discounts, and engaging in smart shopping practices, you can gain control over your insurance costs and ensure financial stability. Remember, proactive engagement with your insurance provider and a commitment to safe driving practices are key to securing the best possible coverage and protecting yourself on the road.