Navigating the world of life insurance can feel overwhelming, especially when trying to find the best rates. The right life insurance policy is crucial for protecting your loved ones financially, but with so many factors influencing premiums, it can be difficult to know where to start. This guide will equip you with the knowledge and strategies to secure the most competitive life insurance rates, ensuring you get the coverage you need at a price that fits your budget.

From understanding the key factors that impact premiums to comparing quotes from top insurers, this comprehensive resource will demystify the process of finding the best life insurance rates. We’ll explore different types of policies, delve into crucial considerations for choosing the right coverage, and offer practical tips for saving money. By the end, you’ll be empowered to make informed decisions and secure a policy that provides peace of mind for your family’s future.

Understanding Life Insurance Rates

Life insurance rates are the monthly or annual premiums you pay for coverage. They are calculated based on several factors that assess your risk as an insured individual. The higher the risk, the higher the premium you’ll pay.

Factors Influencing Life Insurance Rates

Understanding the factors that influence life insurance rates is crucial to securing the best possible coverage at a price that fits your budget. These factors are carefully assessed by insurance companies to determine your individual risk profile.

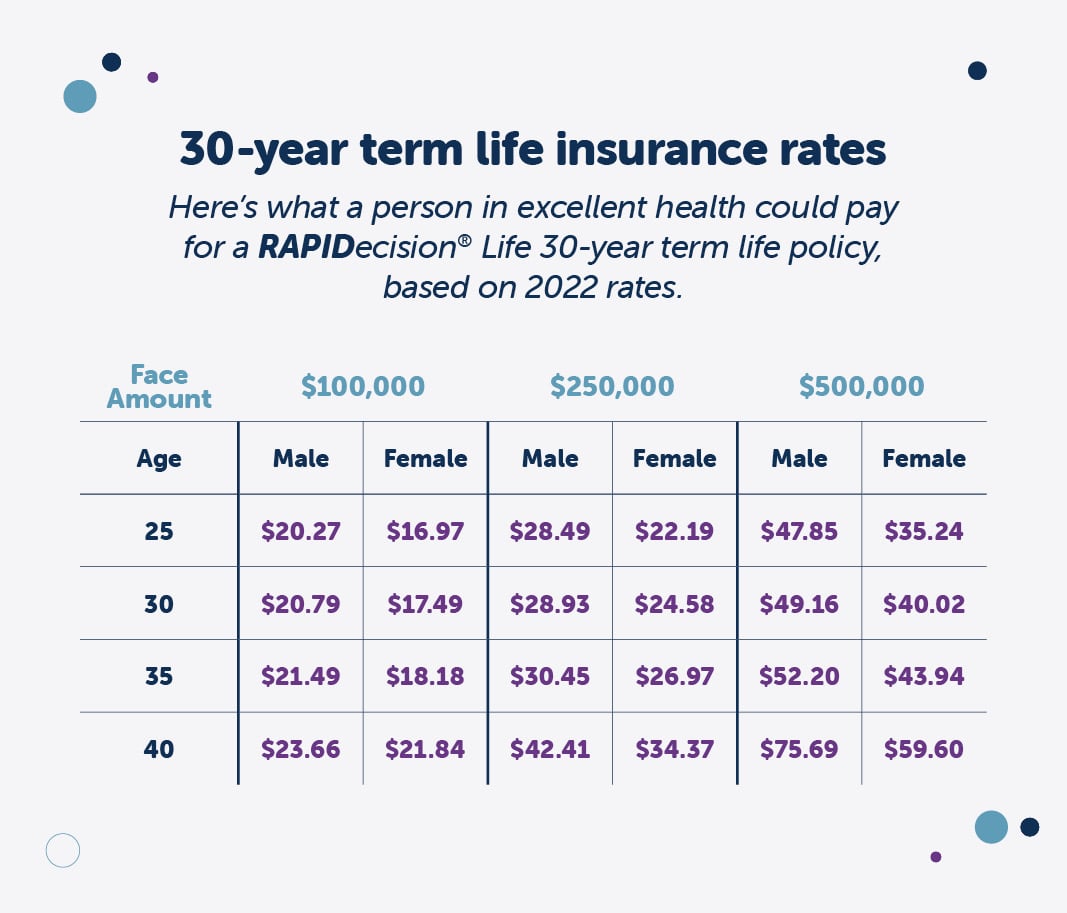

- Age: Younger individuals generally pay lower premiums than older individuals. This is because they have a statistically longer life expectancy. As you age, the risk of mortality increases, leading to higher premiums.

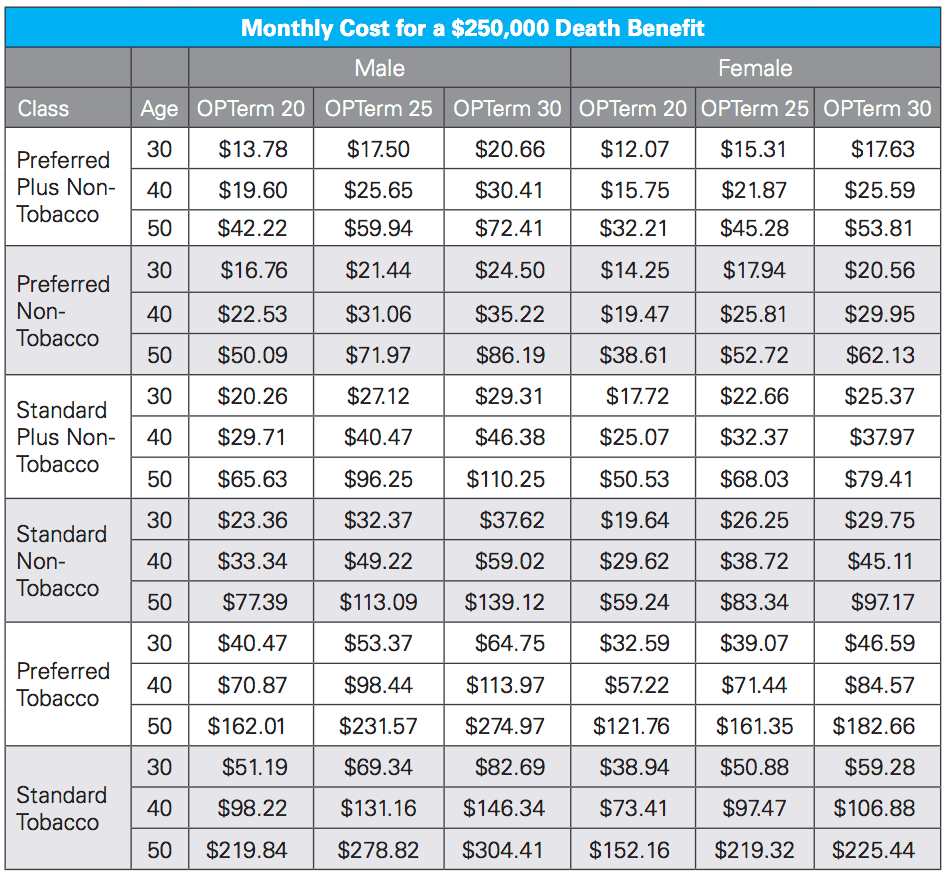

- Health: Your health status is a significant factor in determining your life insurance rate. Individuals with pre-existing medical conditions or a history of health issues may face higher premiums. Insurance companies assess your medical history, current health status, and lifestyle habits to evaluate your risk.

- Lifestyle: Your lifestyle choices, including smoking, alcohol consumption, and dangerous hobbies, can impact your life insurance rates. Engaging in risky activities can increase your risk of mortality, leading to higher premiums.

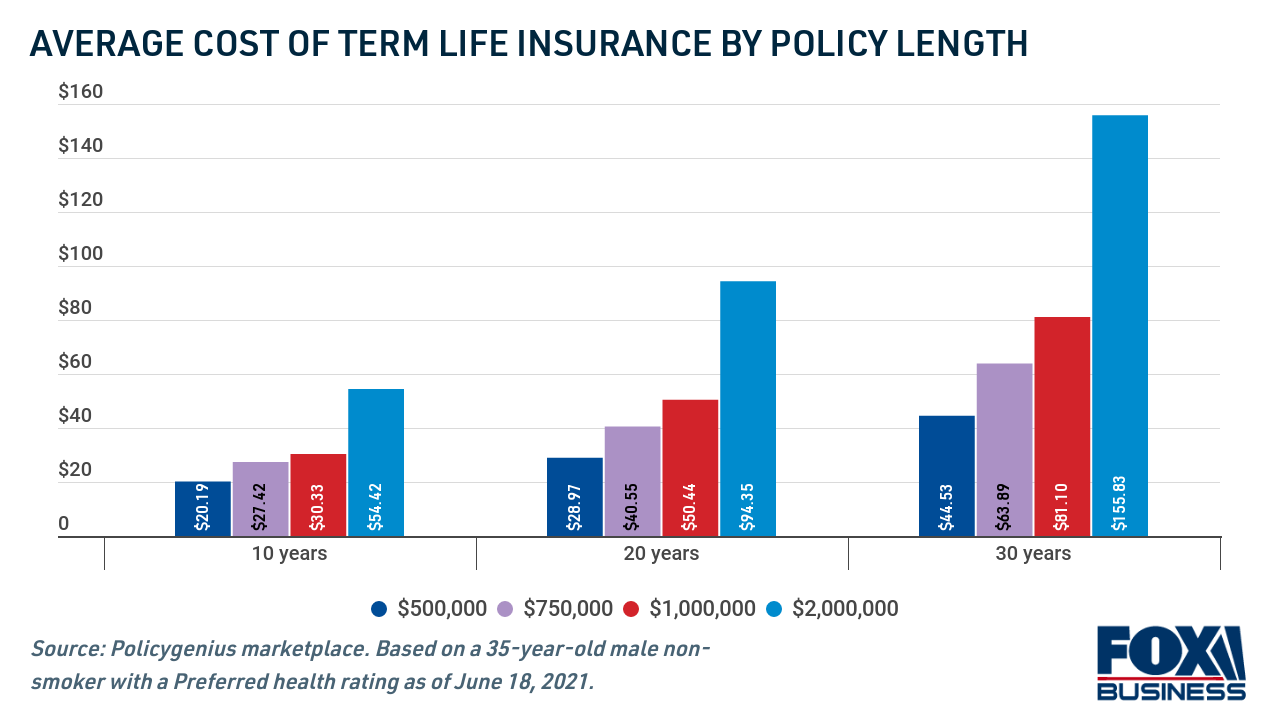

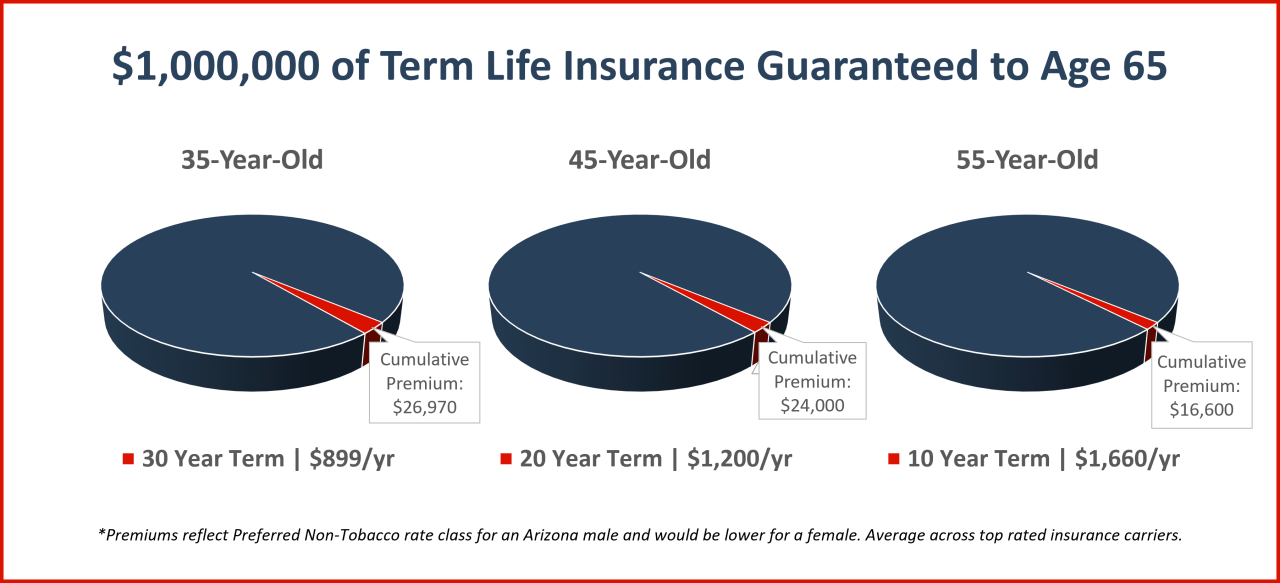

- Coverage Amount: The amount of coverage you choose will also affect your premiums. A higher death benefit, the amount your beneficiaries will receive upon your death, will result in higher premiums.

Age and Life Insurance Rates

Age is a primary factor influencing life insurance rates. Younger individuals typically pay lower premiums than older individuals because they have a longer life expectancy.

- Example: A 25-year-old healthy individual might pay significantly less for a $500,000 life insurance policy than a 55-year-old healthy individual with the same coverage.

Health and Life Insurance Rates

Your health status plays a crucial role in determining your life insurance rate. Individuals with pre-existing medical conditions or a history of health issues may face higher premiums.

- Example: A person with diabetes may pay a higher premium compared to a person without diabetes.

Lifestyle and Life Insurance Rates

Lifestyle choices, such as smoking, alcohol consumption, and dangerous hobbies, can also affect your life insurance rates.

- Example: A smoker may pay a higher premium than a non-smoker, as smoking is a known risk factor for several health issues.

Coverage Amount and Life Insurance Rates

The amount of coverage you choose will also influence your premiums. A higher death benefit will result in higher premiums.

- Example: A $1 million life insurance policy will generally have higher premiums than a $500,000 policy.

Types of Life Insurance and Their Associated Rates

There are different types of life insurance, each with its own associated rates. Understanding the types of life insurance and their characteristics can help you choose the most suitable coverage for your needs.

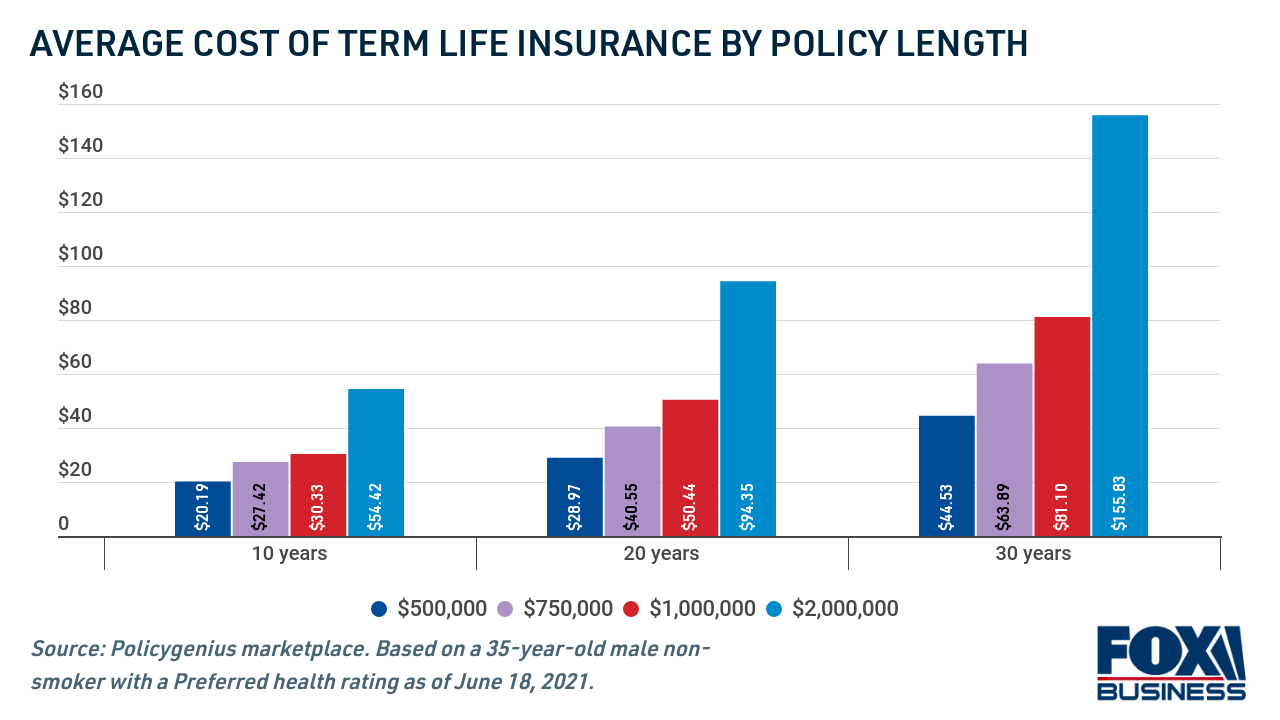

- Term Life Insurance: This type of life insurance provides coverage for a specific period, typically 10, 20, or 30 years. It is generally the most affordable type of life insurance, as it offers temporary coverage. Term life insurance premiums are typically lower than permanent life insurance premiums due to its limited coverage period.

- Permanent Life Insurance: This type of life insurance provides coverage for your entire lifetime. It offers a cash value component that grows over time. Permanent life insurance premiums are generally higher than term life insurance premiums due to its lifelong coverage and cash value feature.

- Whole Life Insurance: This type of permanent life insurance offers fixed premiums and a guaranteed death benefit. It has a cash value component that grows at a fixed rate.

- Universal Life Insurance: This type of permanent life insurance offers flexible premiums and death benefit options. It has a cash value component that grows at a variable rate based on market performance.

- Variable Life Insurance: This type of permanent life insurance offers a death benefit that is linked to the performance of sub-accounts invested in the stock market. It has a cash value component that fluctuates based on the performance of these sub-accounts.

Finding the Best Life Insurance Rates

Securing the most competitive life insurance rates is crucial for ensuring your loved ones are financially protected in the event of your passing. While the process may seem daunting, a little research and strategic planning can lead you to the best rates available.

Comparing Quotes from Multiple Insurers

It is essential to obtain quotes from several life insurance providers to compare their rates, coverage options, and terms. Each insurer uses its own unique underwriting process, which can result in vastly different premiums for the same level of coverage.

Obtaining Life Insurance Quotes

To obtain quotes, you can follow these steps:

- Gather Your Information: Before contacting insurers, gather the necessary information, such as your age, health history, smoking status, desired coverage amount, and preferred policy term. This will streamline the quoting process.

- Use Online Comparison Tools: Numerous websites offer online life insurance quote comparison tools. These platforms allow you to input your information and receive quotes from multiple insurers simultaneously. This saves time and effort.

- Contact Insurers Directly: You can also contact insurers directly through their websites or phone lines to request quotes. Be prepared to provide the same information as mentioned above.

- Consider a Life Insurance Broker: Life insurance brokers work with multiple insurers and can help you navigate the quoting process and find the best rates for your needs. They can provide unbiased advice and assistance with the application process.

Life Insurance Provider Comparison

Below is a table comparing key features and rates of some popular life insurance providers. Please note that rates can vary based on individual factors such as age, health, and coverage amount.

| Provider | Term Life | Whole Life | Average Monthly Premium (Example: $250,000 Coverage) |

|---|---|---|---|

| Company A | $15 – $30 | $40 – $60 | $25 – $40 |

| Company B | $18 – $35 | $45 – $65 | $28 – $45 |

| Company C | $20 – $40 | $50 – $70 | $30 – $50 |

Important Note: These are just examples, and actual rates may vary depending on your individual circumstances. It is always recommended to obtain quotes from multiple insurers to find the best rates for your needs.

Key Considerations for Choosing Life Insurance

Choosing the right life insurance policy is a crucial decision that can have a significant impact on your family’s financial security. The best policy for you will depend on your individual needs, financial situation, and future goals.

Understanding Your Needs and Financial Situation

It is essential to assess your individual needs and financial situation before deciding on a life insurance policy. Consider factors such as:

- Your dependents: Do you have a spouse, children, or other family members who rely on your income?

- Outstanding debts: Do you have any significant debts, such as a mortgage, student loans, or credit card debt?

- Your income: What is your current income, and how much income do you expect to earn in the future?

- Your savings and investments: Do you have any savings or investments that could be used to cover your family’s expenses in the event of your death?

- Your health and lifestyle: Your health and lifestyle can affect the cost of your life insurance premiums.

Term Life Insurance vs. Permanent Life Insurance

There are two main types of life insurance: term life insurance and permanent life insurance.

- Term life insurance provides coverage for a specific period, typically 10, 20, or 30 years. It is generally less expensive than permanent life insurance but does not build cash value. It is often the most suitable option for individuals with a temporary need for coverage, such as during the early years of raising a family or while paying off a mortgage.

- Permanent life insurance provides coverage for your entire life, as long as you continue to pay the premiums. It also builds cash value that can be borrowed against or withdrawn. Permanent life insurance is typically more expensive than term life insurance but can be a good option for individuals who need lifetime coverage or want to build cash value.

Choosing the Right Type of Life Insurance

The best type of life insurance for you will depend on your individual needs and circumstances. Here are some examples of situations where each type of life insurance may be most suitable:

- Term life insurance:

- A young family with a mortgage and young children who need coverage for a specific period, such as the next 20 years.

- An individual with a temporary need for coverage, such as during a period of high debt or while raising a family.

- Permanent life insurance:

- An individual who wants lifetime coverage and the potential to build cash value.

- A business owner who needs a policy that can be used to fund a buy-sell agreement or provide coverage for key employees.

Understanding Life Insurance Policies

Once you’ve determined your life insurance needs and secured the best rates, the next step is to understand the different types of policies available and the features they offer. This knowledge will help you choose the right policy to meet your specific requirements and ensure you have the protection you need.

Types of Life Insurance Riders

Life insurance riders are optional add-ons that can enhance the coverage of your base policy. They provide additional benefits or protection for specific situations. Here are some common types of riders:

- Accidental Death Benefit Rider: This rider pays a lump sum benefit if the insured dies due to an accident. This can be particularly beneficial for individuals in high-risk professions or those who engage in dangerous hobbies.

- Waiver of Premium Rider: This rider waives future premium payments if the insured becomes disabled. This can help ensure your policy remains active even if you are unable to work and pay premiums.

- Guaranteed Insurability Rider: This rider allows you to purchase additional life insurance coverage at predetermined rates, regardless of your health status, at specific points in time. This can be helpful if your health changes or your insurance needs increase.

- Living Benefits Rider: This rider allows you to access a portion of your death benefit while you are still alive. This can be used to pay for long-term care expenses or other significant financial needs.

Understanding Policy Terms and Conditions

It’s crucial to carefully review the terms and conditions of your life insurance policy. These documents Artikel the specifics of your coverage, including the following:

- Death Benefit: This is the amount of money your beneficiaries will receive upon your death. It’s important to ensure this amount is sufficient to meet your family’s financial needs.

- Premium Payments: This Artikels how much you will pay for your policy, including the frequency and duration of payments. Understanding these terms will help you budget for your premiums.

- Exclusions and Limitations: These provisions detail specific circumstances or events that may not be covered by your policy. It’s important to understand these limitations to ensure you have the appropriate coverage.

- Contestability Period: This is a period during which the insurance company can investigate the accuracy of the information you provided in your application. If any inaccuracies are found, the company may void the policy.

Choosing the Right Life Insurance Policy

Selecting the right life insurance policy involves considering several factors:

- Your Needs and Circumstances: Your age, health, family size, income, and financial goals will all influence your life insurance needs.

- Type of Policy: Determine whether you need a term life insurance policy, which provides coverage for a specific period, or a permanent life insurance policy, which provides lifelong coverage.

- Coverage Amount: Calculate the amount of death benefit you need to ensure your family’s financial security.

- Premium Costs: Compare quotes from multiple insurers to find the best rates and coverage that fit your budget.

- Financial Stability of the Insurer: Choose an insurer with a strong financial track record to ensure your policy will be honored.

It’s always a good idea to consult with a qualified financial advisor to get personalized advice on choosing the right life insurance policy for your individual needs.

Common Life Insurance Myths and Misconceptions

Life insurance is a crucial financial tool, but many misconceptions surround it. These myths can deter individuals from securing the necessary coverage for their loved ones. Understanding the truth behind these misconceptions is essential to make informed decisions about life insurance.

Life Insurance Is Too Expensive

The cost of life insurance varies significantly based on factors such as age, health, coverage amount, and policy type. While some policies can be expensive, affordable options are available. Many individuals can secure adequate coverage without breaking the bank. For example, a healthy 30-year-old individual can obtain a $500,000 term life insurance policy for under $50 per month.

Only People With Families Need Life Insurance

This is a common misconception. Life insurance can be beneficial for individuals without dependents, particularly those with outstanding debts or significant financial obligations. For instance, a single entrepreneur with a business loan might benefit from a life insurance policy to protect their business partners or creditors in case of their untimely demise.

I’m Too Young for Life Insurance

Age is a major factor in life insurance premiums, with younger individuals generally paying lower rates. While it may seem unnecessary to purchase life insurance at a young age, it can be advantageous to lock in lower premiums while you are healthy. Waiting until later in life can result in higher premiums or even denial of coverage due to health issues.

Life Insurance Is Only for the Elderly

This is a misconception. Life insurance is essential for individuals of all ages. Young adults, particularly those with dependents or student loans, can benefit from life insurance to provide financial security for their families in case of an unexpected event.

I Can Just Rely on My Savings

Savings are an important part of financial planning, but they may not be sufficient to cover all financial obligations in the event of an untimely death. Life insurance provides a guaranteed lump sum payment that can be used to pay off debts, replace lost income, and cover expenses like funeral costs.

Life Insurance and Financial Planning

Life insurance plays a crucial role in a comprehensive financial plan, acting as a safety net for your loved ones in the event of your untimely demise. It can help protect your family’s financial well-being, ensuring they can maintain their lifestyle, cover outstanding debts, and achieve their long-term financial goals.

Protecting Your Family and Achieving Financial Goals

Life insurance provides financial security for your family by replacing your lost income and covering various expenses. It serves as a vital tool for achieving financial goals, ensuring your loved ones are not burdened with financial hardship during a difficult time.

Life Insurance as a Financial Safety Net

- Debt Coverage: Life insurance proceeds can be used to pay off outstanding debts, such as mortgages, loans, and credit card balances, preventing your family from being overwhelmed by financial obligations.

- Income Replacement: The death benefit from life insurance can provide a regular income stream to your family, helping them maintain their current lifestyle and cover essential expenses like housing, food, and utilities.

- Education Expenses: Life insurance can be used to fund your children’s education, ensuring they have the financial resources to pursue their academic goals and achieve their full potential.

- Final Expenses: Life insurance proceeds can cover funeral costs, legal fees, and other expenses associated with your passing, relieving your family of these financial burdens during a difficult time.

Tips for Saving Money on Life Insurance

Securing life insurance is a crucial step in safeguarding your loved ones’ financial future. However, navigating the complex world of life insurance premiums and policies can be daunting. Understanding the factors that influence rates and implementing effective strategies can help you obtain the best possible coverage at an affordable price.

Maintain a Healthy Lifestyle

Maintaining a healthy lifestyle can significantly impact your life insurance premiums. Insurance companies assess your health risks, and individuals with healthier habits generally qualify for lower rates. Engaging in regular physical activity, maintaining a balanced diet, and avoiding unhealthy habits like smoking can contribute to a lower risk profile.

Improve Your Credit Score

Your credit score is a key factor that insurance companies consider when determining your life insurance premiums. A higher credit score generally indicates financial responsibility and a lower risk of defaulting on payments. To improve your credit score, pay your bills on time, keep your credit utilization low, and avoid opening too many new credit accounts.

Shop Around for Quotes

Obtaining quotes from multiple life insurance companies is crucial for finding the best rates. Each insurer uses its own proprietary algorithms and underwriting criteria to determine premiums. Comparing quotes from several companies can help you identify the most competitive rates and policies that best suit your needs.

Negotiate Your Premium

Negotiating your life insurance premium is a viable strategy for obtaining a lower rate. Insurance companies often have some flexibility in their pricing. Consider factors like your health, credit score, and the policy’s terms and conditions when negotiating. Be prepared to provide evidence of your good health and financial stability.

Explore Discounts and Bundling Options

Many life insurance companies offer discounts for various factors, such as being a nonsmoker, having a good driving record, or holding multiple insurance policies with the same company. Inquire about available discounts and bundle options to maximize your savings.

Consider a Term Life Insurance Policy

Term life insurance policies offer coverage for a specific period, typically 10, 20, or 30 years. These policies are generally more affordable than permanent life insurance policies, which provide lifelong coverage. If you need coverage for a specific period, such as while your children are young or you have outstanding debts, a term life insurance policy may be a cost-effective option.

Understand Your Needs and Coverage

Before purchasing life insurance, carefully assess your financial situation and determine the amount of coverage you require. Over-insuring can be an unnecessary expense, while under-insuring may not provide adequate protection for your loved ones. Consider your income, dependents, debts, and financial goals when making this decision.

Consider a Higher Deductible

If you’re looking to lower your monthly premiums, consider a higher deductible for your life insurance policy. A higher deductible means you’ll pay more out of pocket in the event of a claim, but it can significantly reduce your premium.

Life Insurance and Changing Life Circumstances

Life insurance needs are not static. They evolve as your life changes, and it’s crucial to review and adjust your policy accordingly to ensure it continues to meet your evolving needs. This is especially true as you navigate major life events that can significantly impact your financial obligations and the financial security of your loved ones.

Adjusting Your Life Insurance Policy

The primary reason to adjust your life insurance policy is to maintain adequate coverage. As your life changes, so do your financial obligations. For example, getting married, having children, taking on a mortgage, or starting a business can increase your financial responsibilities.

“A comprehensive review of your life insurance policy every 3 to 5 years, or after any major life event, is generally recommended.”

Life Events That May Trigger a Need to Adjust Coverage

- Marriage or Partnership: Getting married or entering into a long-term partnership can create new financial dependencies, requiring an increase in coverage to protect your spouse or partner in case of your untimely death.

- Having Children: Children bring significant financial obligations, including their education, living expenses, and future needs. Increasing your coverage can help ensure their financial well-being in your absence.

- Purchasing a Home: A mortgage creates a significant debt obligation. Adequate life insurance coverage can ensure that your mortgage is paid off in case of your death, preventing your family from facing foreclosure.

- Starting a Business: Starting a business can involve substantial financial risks. Life insurance can help protect your business partners and ensure the continuity of your company in case of your death.

- Becoming a Grandparent: Grandparents often provide financial support to their grandchildren. Increasing your coverage can help ensure you can continue to provide for them if you pass away.

- Retiring: While retirement may seem like a time to decrease coverage, it’s important to consider potential long-term care expenses and the need to protect your spouse’s financial security.

- Divorce or Separation: Divorce or separation can significantly impact your life insurance needs. You may need to adjust beneficiaries or coverage amounts to reflect your new circumstances.

- Changes in Income: Significant changes in your income, such as a promotion, job loss, or career change, can impact your life insurance needs.

- Health Changes: Major health changes can influence your life insurance needs. You may need to consider additional coverage to protect against potential medical expenses.

Life Insurance Resources and Support

Navigating the world of life insurance can be complex, and seeking guidance from reputable sources can greatly enhance your understanding and decision-making process. Numerous resources are available to provide information, support, and expert advice on life insurance.

Reputable Life Insurance Resources

It’s crucial to consult reliable sources for accurate information on life insurance. Here are some reputable organizations that provide comprehensive resources:

- National Association of Insurance Commissioners (NAIC): The NAIC is a non-profit organization representing state insurance regulators. Their website offers consumer guides, FAQs, and information on state-specific insurance regulations.

- Insurance Information Institute (III): The III is a non-profit organization dedicated to providing information on insurance. Their website features articles, videos, and infographics on various insurance topics, including life insurance.

- Consumer Reports: Consumer Reports is a non-profit organization that conducts independent testing and research on various products and services, including life insurance. Their website provides reviews, ratings, and recommendations for life insurance companies.

- The National Endowment for Financial Education (NEFE): NEFE is a non-profit organization that offers educational resources on personal finance, including life insurance. Their website features articles, calculators, and other tools to help consumers make informed decisions.

Consumer Protection Agencies

In cases of disputes or concerns related to life insurance policies, contacting consumer protection agencies can be helpful. These agencies are designed to protect consumers’ rights and advocate for fair treatment.

- The National Consumer Law Center (NCLC): The NCLC is a non-profit organization that advocates for consumer rights. They provide legal resources and information on various consumer issues, including insurance disputes.

- The Better Business Bureau (BBB): The BBB is a non-profit organization that provides business reviews and consumer protection services. Their website allows consumers to file complaints against businesses, including insurance companies.

- State Insurance Departments: Each state has an insurance department responsible for regulating insurance companies and protecting consumers. Contacting your state’s insurance department can provide information on insurance regulations and assistance with resolving disputes.

Seeking Professional Advice

While online resources can provide valuable information, seeking professional advice from a qualified financial advisor is highly recommended when making significant life insurance decisions.

- Financial Advisors: Financial advisors can provide personalized guidance based on your individual circumstances, financial goals, and risk tolerance. They can help you determine the appropriate type and amount of life insurance coverage.

- Insurance Agents: Insurance agents are licensed professionals who specialize in selling insurance products. They can provide information on various life insurance policies and help you compare different options.

Wrap-Up

Securing the best life insurance rates is about more than just finding the lowest premium. It’s about finding the right balance between affordability and comprehensive coverage that meets your unique needs and circumstances. By taking the time to understand the factors that influence rates, compare quotes, and make informed decisions, you can find a policy that provides financial security for your loved ones without straining your budget. Remember, life insurance is an investment in your family’s future, and finding the best rates allows you to maximize its value and ensure their well-being.