The declaration page, a seemingly simple document accompanying your insurance policy, holds the key to understanding the intricate details of your coverage. It serves as a concise summary of your policy’s key terms and conditions, providing a snapshot of your insurance agreement with the insurer.

This crucial document Artikels your coverage limits, deductibles, premium payments, and other vital information. It acts as a roadmap for navigating the complexities of insurance, ensuring you have a clear understanding of what’s covered, how much you’re paying, and what your responsibilities are as a policyholder.

What is a Declaration Page?

The declaration page, often referred to as the “dec page,” is a crucial document in an insurance policy. It serves as a summary of the key details and terms of your insurance coverage, providing a concise overview of your policy’s essential information.

Purpose and Importance

The declaration page plays a vital role in the insurance process, acting as a central reference point for both the insured and the insurer. It Artikels the specific coverage details, ensuring clarity and transparency regarding the policy’s terms and conditions. This page is essential for:

- Policy Identification: The declaration page uniquely identifies the policy, including the policy number, effective date, and policyholder information.

- Coverage Summary: It provides a concise overview of the covered perils, limits of liability, deductibles, and other relevant coverage details.

- Premium Calculation: The declaration page clearly states the premium amount, payment schedule, and any applicable discounts or surcharges.

- Claims Processing: In the event of a claim, the declaration page serves as a crucial document, providing the necessary information for claim processing and settlement.

Common Information on a Declaration Page

A typical declaration page includes a range of essential information, including:

- Policyholder Information: This includes the name, address, and contact information of the policyholder.

- Insured Property: For property insurance, it details the address, type, and value of the insured property.

- Coverage Details: The declaration page lists the specific coverage types, such as liability, property damage, or personal injury, along with their respective limits and deductibles.

- Premium and Payment Information: It states the premium amount, payment frequency, and any applicable discounts or surcharges.

- Policy Effective Dates: The declaration page clearly indicates the policy’s start and end dates.

- Endorsements and Riders: Any modifications or additions to the original policy, such as endorsements or riders, are noted on the declaration page.

“The declaration page is the cornerstone of an insurance policy, providing a concise summary of the policy’s key features and terms.”

Key Elements of a Declaration Page

The declaration page is the cornerstone of an insurance policy, providing a concise summary of the policy’s key details. It serves as a vital document for both the policyholder and the insurance company, outlining the terms and conditions of the coverage.

Essential Elements of a Declaration Page

The declaration page typically includes several crucial elements that define the scope and parameters of the insurance policy. These elements provide a comprehensive overview of the policy’s coverage, ensuring clarity and transparency for both parties involved.

| Element | Description | Importance | Example |

|---|---|---|---|

| Policy Number | A unique identifier assigned to each insurance policy. | Facilitates policy identification, tracking, and administration. | 1234567890 |

| Policyholder Name | The name of the individual or entity insured under the policy. | Establishes the insured party and their legal rights and obligations. | John Smith |

| Policy Effective Date | The date on which the insurance policy becomes effective and coverage begins. | Determines the period for which coverage is provided and premiums are due. | January 1, 2023 |

| Policy Expiration Date | The date on which the insurance policy expires and coverage ends. | Indicates the duration of coverage and the need for renewal or replacement. | December 31, 2023 |

| Insured Property or Risk | A description of the property or risk covered by the policy. | Defines the scope of coverage and the specific assets or liabilities protected. | Residential dwelling located at 123 Main Street |

| Coverage Limits | The maximum amount the insurance company will pay for covered losses. | Provides financial protection and sets the limits of liability. | $500,000 for dwelling coverage, $100,000 for personal property coverage |

| Deductible | The amount the policyholder is responsible for paying before the insurance company covers any losses. | Reduces premiums and encourages policyholders to take preventive measures. | $1,000 deductible for each covered claim |

| Premium Amount | The cost of the insurance policy, typically paid in installments or a lump sum. | Represents the policyholder’s financial commitment for coverage. | $1,000 annual premium |

| Insurer Name and Address | The name and contact information of the insurance company providing coverage. | Identifies the insurer and facilitates communication and claims processing. | ABC Insurance Company, 123 Main Street, Anytown, USA |

| Agent Name and Contact Information | The name and contact information of the insurance agent who sold the policy. | Provides a point of contact for policyholders seeking assistance or information. | Jane Doe, 555-123-4567 |

Types of Insurance Policies and Declaration Pages

Declaration pages serve as concise summaries of key insurance policy details, providing a snapshot of coverage and policyholder information. While the fundamental elements remain consistent across different policy types, the specific information presented can vary depending on the nature of the insurance.

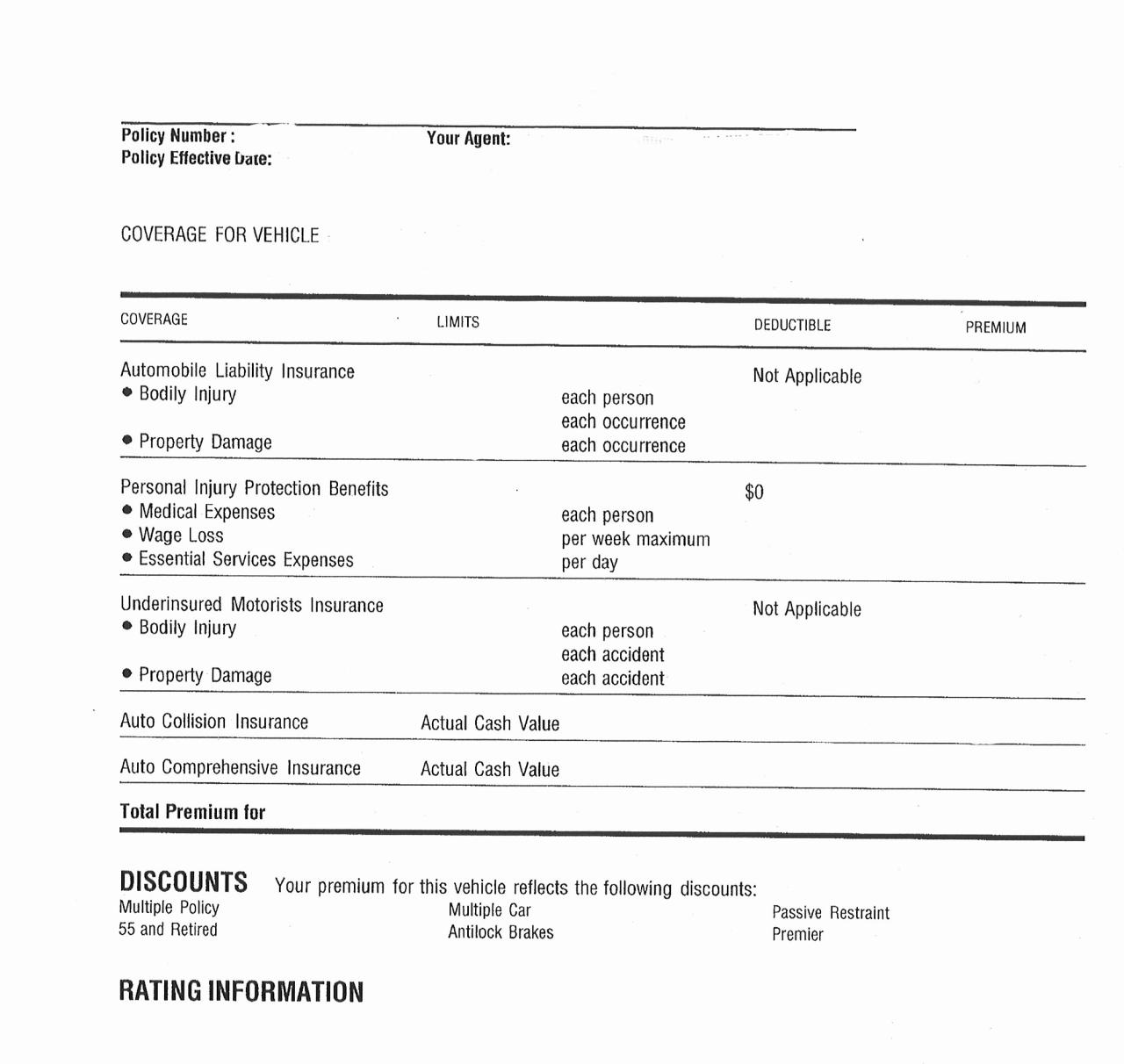

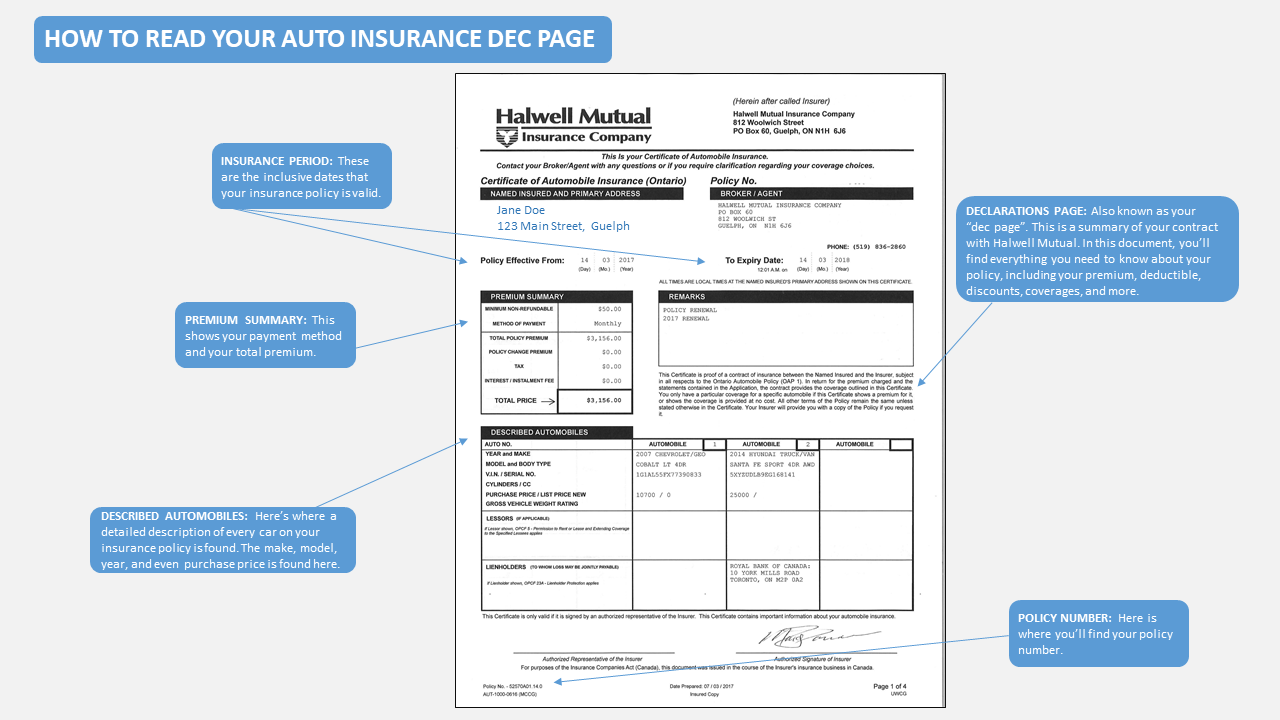

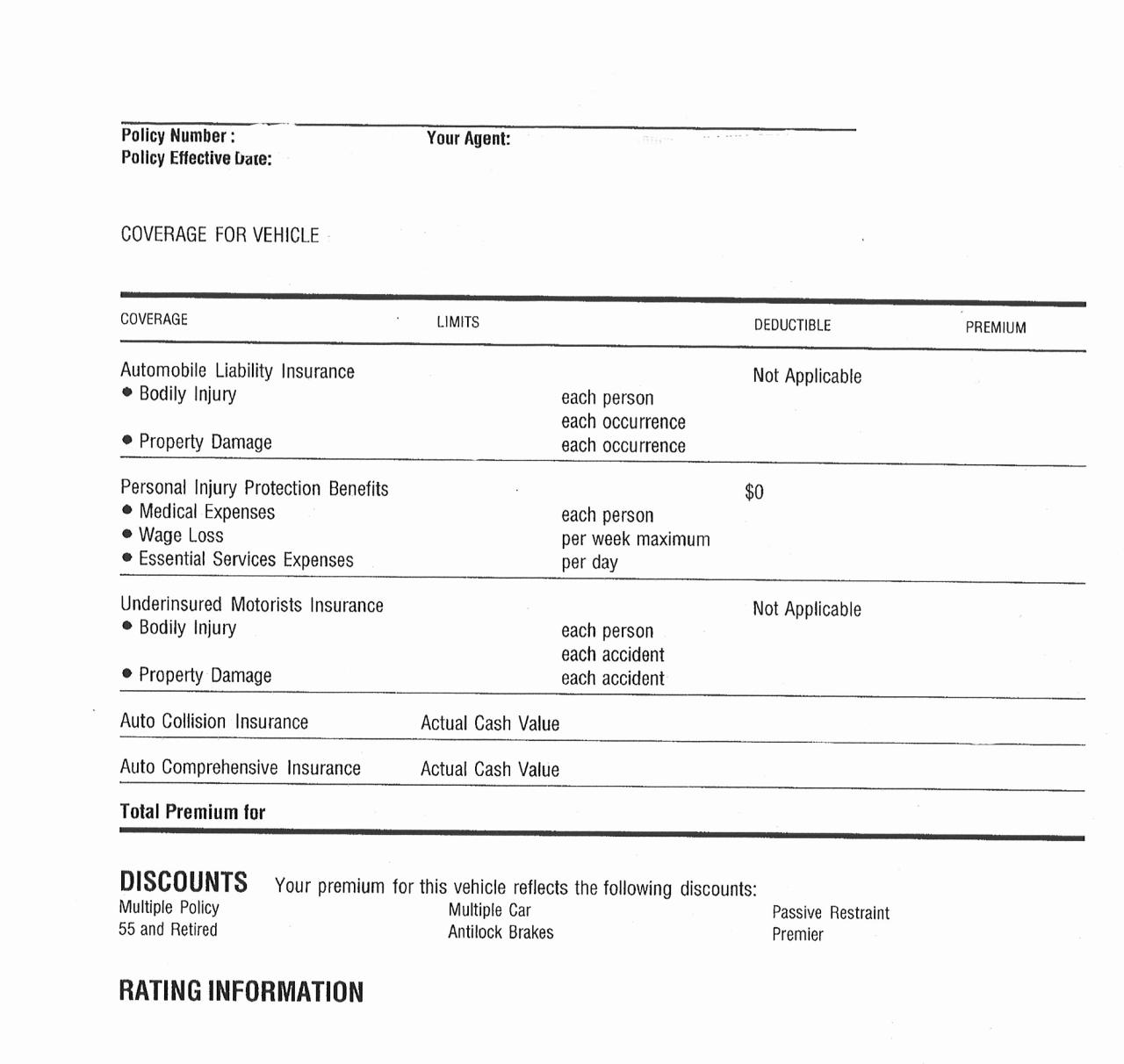

Auto Insurance Declaration Pages

Auto insurance declaration pages typically include details specific to the insured vehicle, such as the make, model, year, and vehicle identification number (VIN). They also Artikel coverage details, including liability limits, collision and comprehensive coverage, and any deductibles. Additionally, information about the insured driver(s), including their names, addresses, and driving history, is presented.

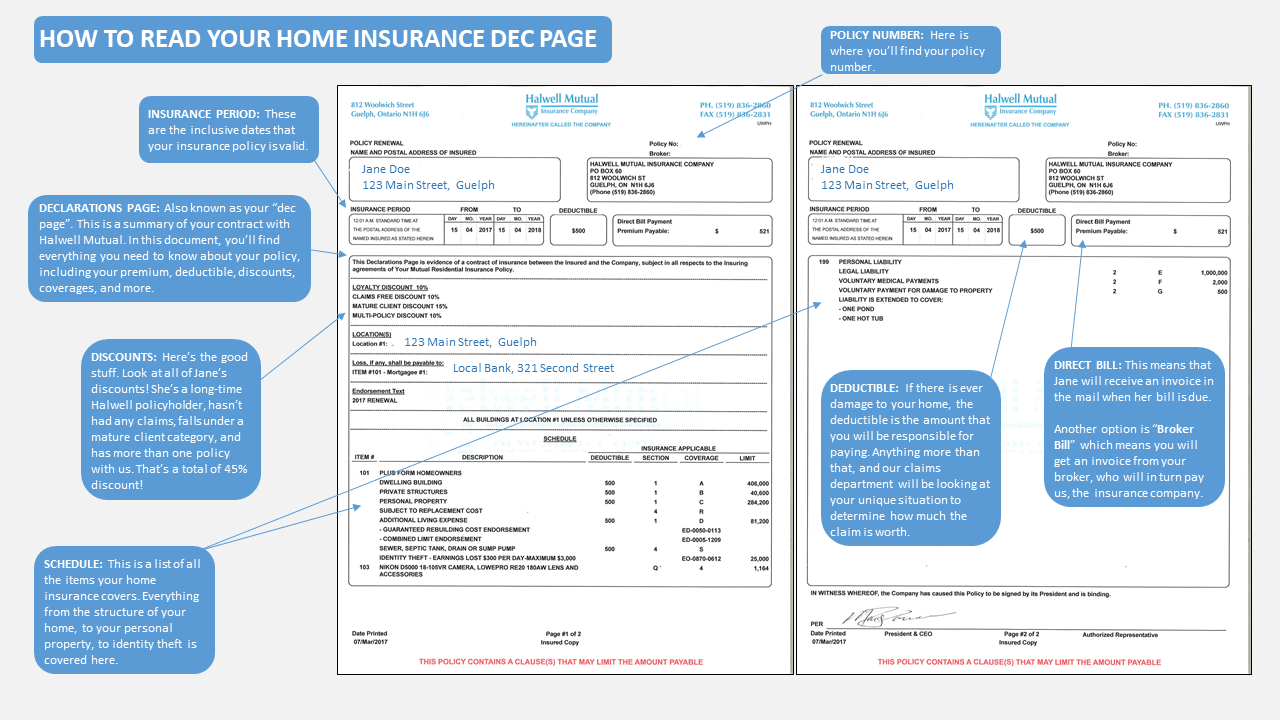

Home Insurance Declaration Pages

Home insurance declaration pages often feature information about the insured property, such as its address, square footage, construction type, and estimated value. They also specify coverage details, including dwelling coverage, personal property coverage, liability limits, and deductibles. The declaration page may also include information about any special endorsements or riders, such as coverage for valuable possessions or specific perils.

Health Insurance Declaration Pages

Health insurance declaration pages primarily focus on coverage details and plan specifics. They typically include the policyholder’s name, policy number, effective dates, and the type of plan (e.g., HMO, PPO, EPO). They may also Artikel deductibles, copayments, coinsurance, and coverage limitations.

Life Insurance Declaration Pages

Life insurance declaration pages usually include the policyholder’s name, beneficiary information, policy type (e.g., term life, whole life), death benefit amount, and premium payment details. They may also specify any riders or additional coverage options, such as accidental death benefits or living benefits.

Understanding Policy Coverage

The declaration page acts as a crucial bridge between the comprehensive terms and conditions of an insurance policy and the specific coverage you are entitled to. It summarizes the key details of your policy, providing a clear and concise overview of your protection.

Relationship between the Declaration Page and Policy Terms

The declaration page is essentially a snapshot of your insurance policy, reflecting the coverage you have purchased based on the broader terms and conditions Artikeld in the policy document. It Artikels the specific details of your policy, such as coverage limits, deductibles, and exclusions, all of which are defined in greater detail within the policy itself. The declaration page, therefore, serves as a concise reference point, providing a quick summary of your coverage while directing you to the full policy document for detailed information.

Coverage Limits and Exclusions

The declaration page clarifies the extent of your coverage by outlining specific limits and exclusions. Coverage limits define the maximum amount the insurer will pay for a covered claim. For instance, the declaration page might specify a liability limit of $1 million for bodily injury or property damage caused by an accident. This means that the insurer will pay up to $1 million for such claims, but no more.

Example: A homeowner’s insurance policy with a dwelling coverage limit of $300,000 on the declaration page indicates that the insurer will pay up to $300,000 for damage to the insured dwelling, assuming the damage is covered under the policy terms.

Exclusions, on the other hand, specify events or circumstances that are not covered by the policy. These are often detailed in the policy document, but the declaration page may provide a summary of the main exclusions. For instance, a homeowner’s policy might exclude coverage for damage caused by earthquakes or floods.

Example: An auto insurance policy with an exclusion for damage caused by wear and tear on the declaration page indicates that the insurer will not cover repairs resulting from normal wear and tear on the insured vehicle.

Understanding the coverage limits and exclusions listed on your declaration page is essential for managing your risk effectively. It allows you to assess the adequacy of your coverage and consider additional insurance options or adjustments to your policy if necessary.

Premium Calculation and Payment

The declaration page is the heart of an insurance policy, and it plays a crucial role in determining the premium you pay. It summarizes the key details of your policy, including coverage amounts, deductibles, and the policy period, all of which influence the cost of your insurance.

Factors Influencing Premium Calculation

The declaration page contains several key elements that directly impact your premium calculation. These elements reflect your individual risk profile and the specific coverage you’ve chosen.

- Coverage Amounts: This refers to the maximum amount the insurer will pay for covered losses, such as the value of your home in a homeowners policy or the medical expenses in a health insurance policy. Higher coverage amounts generally translate to higher premiums.

- Deductibles: This is the amount you pay out-of-pocket before the insurance kicks in. A higher deductible usually means a lower premium. The declaration page clearly states the deductible amount for each type of coverage you have.

- Policy Period: This refers to the duration of your insurance coverage, typically expressed in years or months. Premiums are calculated based on the policy period. Shorter policy periods may result in a higher premium per unit of time, while longer periods often come with a discount.

- Other Factors: In addition to these core elements, the declaration page may also reflect other factors that influence your premium, such as your location, age, driving record (for auto insurance), or credit score. These factors can be further detailed in the policy’s terms and conditions.

Premium Payment Schedule and Methods

The declaration page also provides information about your premium payment schedule and the accepted payment methods. This information helps you understand how much you need to pay and when, ensuring you maintain active coverage.

- Payment Frequency: The declaration page typically specifies whether you pay your premium annually, semi-annually, quarterly, or monthly. The payment frequency impacts the amount you pay per installment.

- Payment Due Dates: The declaration page will clearly state the due dates for each premium payment. It’s crucial to make payments on time to avoid any lapse in coverage.

- Payment Methods: The declaration page Artikels the acceptable payment methods, such as checks, money orders, credit cards, or online payments. You can choose the most convenient option for you.

Policyholder Responsibilities

The declaration page is not just a summary of your insurance policy; it also Artikels your responsibilities as a policyholder. Understanding these responsibilities is crucial for ensuring you have the right coverage and avoiding any potential issues or claims denials.

Reviewing the Declaration Page for Accuracy

It is vital to thoroughly review your declaration page upon receipt to ensure accuracy. This includes verifying the following details:

- Policyholder information: Ensure your name, address, and contact details are correct.

- Policy details: Confirm the policy type, coverage limits, effective dates, and premium amount are accurate.

- Covered property or assets: Verify that all insured property or assets are listed correctly.

- Exclusions and limitations: Carefully read through any exclusions or limitations that might affect your coverage.

If you find any discrepancies, immediately contact your insurer to correct them. A simple error on the declaration page could have significant consequences during a claim.

Notifying the Insurer of Changes

It is your responsibility to keep your insurer informed of any changes that could affect your policy. This includes:

- Change of address: Updating your address is crucial for receiving important policy documents and ensuring you receive timely communication from your insurer.

- Change of ownership: If you sell or transfer ownership of the insured property, notify your insurer immediately. Failure to do so could invalidate your coverage.

- Changes in the insured property: Significant changes to the insured property, such as renovations, additions, or improvements, should be reported to your insurer. This ensures your coverage reflects the current value of the property.

- Changes in your personal circumstances: Significant changes in your personal circumstances, such as marriage, divorce, or the addition of a new driver to your household, might require updating your policy details.

Promptly notifying your insurer of changes ensures your policy remains accurate and provides appropriate coverage for your needs.

Examples of Situations Requiring Declaration Page Updates

Here are some examples of situations where policyholders may need to update their declaration page information:

- Purchasing a new car: Adding a new vehicle to your auto insurance policy requires updating your declaration page with the new car’s details, including make, model, year, and VIN.

- Moving to a new home: Updating your homeowner’s insurance policy with your new address is essential for ensuring your coverage remains active.

- Adding a new business: If you start a new business, you may need to update your commercial insurance policy to include the new business details.

- Getting married: Updating your life insurance policy to reflect your new marital status and beneficiaries is important for ensuring your loved ones are protected.

It’s essential to be proactive in updating your declaration page to maintain accurate coverage and avoid any potential issues during a claim.

Claim Processing and Declaration Page

The declaration page serves as a vital document in the claim processing procedure, providing insurers with essential information to assess the validity of claims and expedite the payout process.

Declaration Page’s Role in Claim Assessment

The declaration page contains crucial details that help insurers verify the legitimacy of claims. These details include:

- Policyholder information: This includes the insured’s name, address, and contact information, which helps insurers confirm the identity of the claimant.

- Policy details: The declaration page Artikels the policy’s coverage limits, deductibles, and effective dates. This information enables insurers to determine if the claim falls within the policy’s scope and assess the extent of coverage.

- Covered perils: The declaration page specifies the perils covered by the policy, such as fire, theft, or natural disasters. This helps insurers verify if the event that caused the loss is covered under the policy.

- Premium information: The declaration page includes the premium amount and payment schedule. This information allows insurers to verify if the policyholder has paid the premium and is eligible for coverage.

Examples of Using the Declaration Page in Claim Verification

Here are some examples of how the declaration page can be used to verify policy coverage and payment details during claims:

- A homeowner files a claim for damage caused by a fire. The declaration page confirms the policy’s coverage for fire damage and the insured’s premium payment history, verifying the policy’s validity and the homeowner’s eligibility for compensation.

- A car owner files a claim for a collision accident. The declaration page reveals the policy’s coverage limits for collision damage and the deductible amount. This information helps the insurer determine the extent of coverage and the insured’s financial responsibility.

- A business owner files a claim for a theft loss. The declaration page details the policy’s coverage for theft and the insured’s business address. This information allows the insurer to verify the location of the theft and the policy’s applicability to the claim.

Legal Considerations

The declaration page plays a crucial role in insurance contracts, serving as a foundation for legal proceedings related to coverage disputes. It encapsulates the key terms and conditions of the policy, outlining the insured’s responsibilities and the insurer’s obligations. Understanding the legal implications of the declaration page is vital for both policyholders and insurers to navigate potential legal challenges.

Evidence in Legal Disputes

The declaration page can be used as compelling evidence in legal disputes concerning insurance coverage. This document serves as a written record of the agreed-upon terms, including policy details, coverage limits, and premiums. In cases of claim denials or disputes over coverage, the declaration page provides a clear reference point for both parties and the court to determine the scope of the policy and the insured’s rights.

For example, in a case involving a car accident, the declaration page could be used to prove the existence of liability coverage and the limits of the policy. If the declaration page indicates that the insured had $100,000 in liability coverage, the insurer would be legally obligated to pay up to that amount for damages caused by the insured’s negligence.

Examples of Legal Cases

Numerous legal cases have demonstrated the significance of the declaration page in resolving insurance claims. Here are some illustrative examples:

- Case 1: Policy Renewal and Coverage Disputes: In a case involving a homeowner’s insurance policy, the insured claimed coverage for damages caused by a storm. However, the insurer denied the claim, arguing that the policy had expired. The declaration page, which clearly indicated the policy’s renewal date, proved that the policy was in effect at the time of the storm, leading to the insurer being held liable for the claim.

- Case 2: Coverage Limits and Claim Settlement: A car accident resulted in significant damages to the insured’s vehicle. The insurer offered a settlement amount below the actual cost of repairs. The insured, using the declaration page as evidence, demonstrated that the policy’s coverage limit exceeded the offered settlement, ultimately forcing the insurer to pay the full amount.

Importance of Review and Understanding

Your insurance declaration page is a crucial document that Artikels the terms and conditions of your insurance policy. It’s essential to carefully review and understand this document to ensure your coverage aligns with your needs and expectations. Failing to do so could result in significant financial consequences if you need to file a claim.

Understanding the Declaration Page

Thorough comprehension of the declaration page is critical. This document contains vital information about your policy, including coverage details, premiums, and policyholder responsibilities. Failing to understand these elements can lead to:

* Missed Coverage: You might be unaware of specific coverages or exclusions within your policy, leading to potential financial losses in the event of a claim.

* Incorrect Premiums: Errors in the declaration page might result in overpaying or underpaying your premiums.

* Missed Deadlines: Important deadlines, such as payment due dates or notification requirements, could be overlooked, potentially jeopardizing your policy.

Practical Tips for Reviewing the Declaration Page

Here are some practical tips for effectively reviewing your declaration page:

* Read Carefully: Take your time to read through the entire document, paying close attention to the fine print.

* Verify Accuracy: Compare the information on the declaration page with your policy application and other relevant documents.

* Ask Questions: Don’t hesitate to contact your insurance agent or company if you have any questions or require clarification.

* Keep Records: Maintain a copy of your declaration page for easy reference and future comparison.

* Regular Review: Review your declaration page periodically, especially when your policy is renewed or if you make any changes to your coverage.

Final Wrap-Up

In essence, the declaration page is the cornerstone of your insurance policy, offering a comprehensive overview of your coverage and responsibilities. By carefully reviewing and understanding this document, you can ensure that you’re adequately protected and prepared for any unforeseen circumstances.