Navigating the complex world of homeowners insurance can feel like deciphering a foreign language. But understanding the intricacies of quotes is crucial for securing the right coverage at the best possible price. This guide dives deep into the factors that shape homeowners insurance quotes, empowering you to make informed decisions and find the policy that fits your unique needs.

From the different types of coverage to the key factors influencing premiums, we’ll break down the essential components of a quote and provide actionable tips for getting the most competitive rates. Whether you’re a seasoned homeowner or a first-time buyer, this comprehensive guide will equip you with the knowledge to confidently navigate the insurance landscape.

Understanding Homeowners Insurance Quotes

Securing homeowners insurance is a crucial step in protecting your most valuable asset. Understanding how insurance quotes are calculated is essential to make informed decisions about your coverage. This guide will delve into the factors that influence your homeowners insurance premium, breaking down the components of a quote and offering tips for obtaining accurate and competitive rates.

Factors Influencing Homeowners Insurance Quotes

Several factors influence the cost of homeowners insurance, including:

- Location: The risk of natural disasters, crime rates, and the cost of construction materials in your area all play a role in determining your premium.

- Home Value: The higher the value of your home, the more expensive your insurance will be, as the insurer needs to cover a greater potential loss.

- Coverage Amount: The amount of coverage you choose, including dwelling coverage, personal property coverage, and liability coverage, will impact your premium.

- Deductible: A higher deductible, the amount you pay out-of-pocket before your insurance kicks in, typically results in lower premiums.

- Home Features: Features like security systems, fire alarms, and impact-resistant roofing can reduce your premium by demonstrating a lower risk of loss.

- Credit Score: In some states, insurance companies use credit scores as a proxy for risk assessment, with higher scores often correlating with lower premiums.

- Claim History: Previous claims, even if they were not your fault, can increase your premium as insurers perceive you as a higher risk.

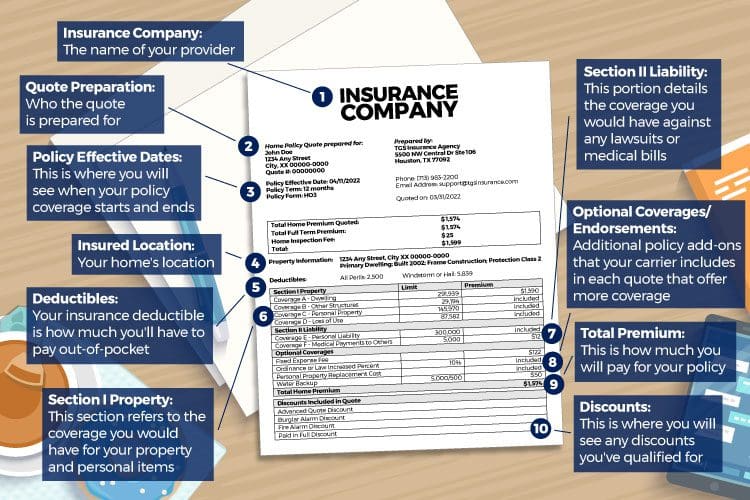

Components of a Homeowners Insurance Quote

A homeowners insurance quote typically consists of the following components:

- Coverage: This refers to the types of risks covered by your policy, including dwelling coverage, personal property coverage, liability coverage, and additional living expenses coverage.

- Deductibles: The deductible is the amount you pay out-of-pocket for each covered claim before your insurance coverage kicks in. A higher deductible generally leads to lower premiums.

- Premiums: Your premium is the amount you pay regularly, typically monthly or annually, for your insurance coverage.

Tips for Getting Accurate and Competitive Quotes

- Shop Around: Compare quotes from multiple insurance companies to find the best rates and coverage options. Online comparison tools can streamline this process.

- Provide Accurate Information: When obtaining quotes, be sure to provide accurate information about your home, coverage needs, and risk factors. This will ensure you receive an accurate and competitive quote.

- Consider Bundling: Bundling your homeowners insurance with other policies, such as auto insurance, can often result in discounts.

- Negotiate: Don’t be afraid to negotiate with insurers to try to secure a lower premium. Highlight any risk-reducing features of your home, such as security systems or impact-resistant roofing, and consider increasing your deductible.

Types of Homeowners Insurance Coverage

Homeowners insurance is a crucial component of protecting your financial well-being, offering a safety net against unexpected events that could damage your property or lead to financial liabilities. Understanding the different types of coverage included in a homeowners insurance policy is essential to ensure you have adequate protection for your specific needs.

Dwelling Coverage

Dwelling coverage is the primary component of homeowners insurance, providing financial protection for your home’s structure. It covers repairs or replacement costs for damage caused by covered perils, such as fire, windstorms, hail, and vandalism. The amount of dwelling coverage you need depends on the replacement cost of your home, considering factors like construction materials, size, and location.

Personal Property Coverage

Personal property coverage protects your belongings within your home, such as furniture, electronics, clothing, and jewelry. This coverage typically applies to items both inside and outside your home, including those in your garage or shed. You can choose from different coverage options, such as actual cash value (ACV) or replacement cost value (RCV). ACV considers depreciation, while RCV covers the full replacement cost of your belongings, regardless of their age or condition.

Liability Coverage

Liability coverage protects you from financial losses resulting from accidents or injuries that occur on your property. This coverage can help pay for medical expenses, legal fees, and settlements for third parties who are injured on your property or as a result of your actions. The amount of liability coverage you need depends on your individual circumstances and the potential risks associated with your property.

Additional Living Expenses Coverage

Additional living expenses (ALE) coverage provides financial assistance if you are unable to live in your home due to a covered event. This coverage helps pay for temporary housing, meals, and other essential living expenses while your home is being repaired or rebuilt. The amount of ALE coverage you need depends on your living expenses and the potential duration of your displacement.

Other Coverage Options

Homeowners insurance policies often include additional coverage options, such as:

- Personal Injury Coverage: Protects you from claims arising from libel, slander, or invasion of privacy.

- Medical Payments Coverage: Covers medical expenses for guests injured on your property, regardless of fault.

- Loss of Use Coverage: Provides financial assistance for additional expenses incurred due to a covered event, such as temporary housing or transportation.

- Ordinance or Law Coverage: Covers the cost of bringing your home up to current building codes after a covered event.

- Water Backup Coverage: Protects against damage caused by water backups from plumbing, sump pumps, or sewer lines.

Coverage for Specific Risks

Having adequate coverage for specific risks, such as natural disasters or theft, is crucial for comprehensive protection.

Natural Disasters

Homeowners insurance policies typically cover damage caused by natural disasters, such as hurricanes, tornadoes, earthquakes, and floods. However, coverage for specific natural disasters may vary depending on your location and the insurer’s policies. It is essential to review your policy and ensure you have sufficient coverage for the specific risks in your area.

Theft

Homeowners insurance policies typically cover theft of personal property from your home. However, there may be limits on the amount of coverage for specific items, such as jewelry or valuable artwork. You may need to purchase additional coverage or a separate policy for valuable items to ensure adequate protection.

Examples of Situations Where Different Types of Coverage Might Be Needed

- Fire Damage: Dwelling coverage would be used to repair or replace the damaged structure, while personal property coverage would cover the cost of replacing damaged belongings.

- Windstorm Damage: Dwelling coverage would cover repairs to the roof, windows, or siding damaged by a windstorm.

- Theft of Jewelry: Personal property coverage would be used to replace stolen jewelry, but you may need to purchase additional coverage for valuable items to ensure adequate protection.

- Liability Claim: Liability coverage would be used to pay for medical expenses or legal fees if a guest is injured on your property.

- Natural Disaster Displacement: Additional living expenses coverage would help pay for temporary housing and other essential expenses if you are unable to live in your home due to a covered event.

Factors Affecting Homeowners Insurance Premiums

Your homeowners insurance premium is determined by a variety of factors that assess your individual risk. These factors help insurance companies understand the likelihood of you filing a claim and the potential cost of that claim.

Location

The location of your home is a significant factor in determining your homeowners insurance premium. This is because different areas have varying levels of risk for natural disasters, crime, and other perils.

- Natural Disasters: Homes located in areas prone to hurricanes, earthquakes, wildfires, or floods will generally have higher premiums. For instance, homeowners in coastal areas might pay more due to the risk of hurricanes, while those living in areas with high wildfire risk may face higher premiums due to the possibility of wildfires.

- Crime Rates: Areas with high crime rates often have higher insurance premiums. This is because insurance companies are more likely to face claims for theft or vandalism in high-crime areas.

Age and Condition of the Home

The age and condition of your home also play a significant role in determining your insurance premium.

- Age: Older homes may have outdated electrical wiring, plumbing, or roofing systems, which can increase the risk of fire or other damage. As a result, insurance companies may charge higher premiums for older homes.

- Condition: Homes in good condition with well-maintained systems generally have lower premiums. Insurance companies may offer discounts for homes with features that reduce the risk of damage, such as fire alarms, security systems, or impact-resistant windows.

Other Factors

Several other factors can influence your homeowners insurance premium, including:

- Credit Score: A higher credit score generally translates to lower insurance premiums. This is because insurance companies often view individuals with good credit as more responsible and less likely to file claims.

- Claims History: Your claims history is a significant factor in determining your premium. If you have filed multiple claims in the past, insurance companies may view you as a higher risk and charge you a higher premium.

- Deductible: The amount of your deductible, which is the amount you pay out of pocket before your insurance coverage kicks in, can also affect your premium. A higher deductible generally results in a lower premium, while a lower deductible means a higher premium.

- Coverage Amount: The amount of coverage you choose for your home and belongings can also influence your premium. Higher coverage amounts typically result in higher premiums.

Getting the Best Homeowners Insurance Quote

Securing the most favorable homeowners insurance quote necessitates a strategic approach. It involves a comprehensive evaluation of various insurance providers and their offerings, coupled with a thorough understanding of your individual needs and risk factors.

Comparing Insurance Providers and Their Offerings

A key step in obtaining the best homeowners insurance quote is comparing different insurance providers and their offerings. This involves examining their coverage options, pricing structures, and customer service reputation.

- Coverage Options: Different insurers may offer varying levels of coverage, such as personal property, liability, and dwelling coverage. It is crucial to compare the specific details of each policy to ensure it aligns with your individual needs and risk profile.

- Pricing Structures: Insurance premiums are calculated based on various factors, including the value of your home, its location, and your credit history. It is essential to compare quotes from multiple insurers to identify the most competitive pricing.

- Customer Service Reputation: Consider the insurer’s reputation for customer service, claims handling, and responsiveness. Reviews from existing customers can provide valuable insights into their overall experience.

Key Features and Pricing for Popular Insurance Companies

To provide a clearer picture of the market, consider the following table outlining key features and pricing for some popular insurance companies. This information is based on average national rates and may vary depending on individual circumstances.

| Insurance Company | Coverage Options | Average Annual Premium | Customer Service Rating |

|---|---|---|---|

| Company A | Comprehensive, including flood and earthquake coverage | $1,200 | 4.5/5 |

| Company B | Standard coverage with optional add-ons | $1,000 | 4/5 |

| Company C | Limited coverage with competitive pricing | $800 | 3.5/5 |

Step-by-Step Guide to Obtaining the Best Quote

To obtain the best possible homeowners insurance quote, follow these steps:

- Gather Essential Information: Compile all necessary details about your home, including its square footage, age, construction materials, and any recent renovations.

- Compare Quotes from Multiple Insurers: Request quotes from at least three different insurance providers to ensure you have a comprehensive understanding of the market.

- Review Policy Details: Carefully examine each policy’s coverage details, including deductibles, limits, and exclusions.

- Consider Discounts: Inquire about any potential discounts, such as those for home security systems, fire alarms, or bundling multiple insurance policies.

- Negotiate Premium Rates: If you find a policy that meets your needs, consider negotiating the premium rate with the insurer.

- Review and Finalize: Once you have chosen a policy, carefully review the final documentation before signing.

Understanding Policy Exclusions and Limitations

While homeowners insurance offers crucial protection against various risks, it’s essential to understand that certain events or situations are specifically excluded from coverage. These exclusions and limitations are Artikeld in the policy documents, and failing to comprehend them could lead to unexpected financial burdens in case of a claim.

Common Exclusions and Limitations

It’s crucial to understand the specific exclusions and limitations Artikeld in your policy. This section will explore common exclusions found in homeowners insurance policies.

- Acts of War or Terrorism: Homeowners insurance typically doesn’t cover damage resulting from acts of war or terrorism. These events are considered high-risk and often involve widespread destruction, making them difficult to insure.

- Natural Disasters: While some policies may offer optional coverage for specific natural disasters like earthquakes or floods, most standard homeowners insurance policies exclude these events. Coverage for such disasters may require separate insurance policies.

- Neglect or Intentional Damage: Homeowners insurance doesn’t cover damage resulting from neglect, such as failing to maintain your property or intentionally causing damage. This includes situations like allowing a roof to leak or intentionally setting fire to your home.

- Normal Wear and Tear: Homeowners insurance doesn’t cover damage resulting from normal wear and tear. This includes things like faded paint, cracked pavement, or worn-out appliances. These are considered expected deterioration over time and not covered by insurance.

- Certain Types of Property: Homeowners insurance may exclude coverage for specific types of property, such as valuable collectibles, artwork, or jewelry. These items might require separate insurance policies or endorsements for adequate coverage.

The Role of Home Improvements in Insurance Costs

Making home improvements can significantly impact your homeowners insurance premiums. While some upgrades can increase your costs, others can lead to lower premiums. Understanding this relationship is crucial for making informed decisions about your home and your insurance coverage.

Home Improvements That Increase Insurance Costs

Home improvements that increase the value of your home can lead to higher insurance premiums. This is because insurance companies base premiums on the value of the property, and a more valuable home represents a greater risk for the insurer.

- Additions: Adding a new room, deck, or garage increases the overall size of your home, which in turn raises its value and your insurance premiums.

- High-End Materials: Using premium materials for renovations, such as exotic woods or imported marble, can significantly increase the value of your home, leading to higher insurance costs.

- Luxury Upgrades: Features like swimming pools, hot tubs, and elaborate landscaping can increase your home’s value and, consequently, your insurance premiums.

Home Improvements That Can Lower Insurance Costs

There are numerous home improvements that can reduce your insurance premiums by mitigating risks. These improvements demonstrate to insurers that your home is safer and less prone to damage.

- Security Systems: Installing a security system with alarms and monitoring can significantly lower your insurance premiums. Insurers recognize that these systems deter theft and vandalism, reducing the risk of claims.

- Fire-Resistant Materials: Using fire-resistant materials for roofing, siding, and insulation can significantly reduce the risk of fire damage. This risk reduction is often reflected in lower insurance premiums.

- Smoke Detectors and Sprinkler Systems: Installing smoke detectors and sprinkler systems can significantly reduce the risk of fire damage, leading to lower insurance premiums. These systems provide early detection and suppression, minimizing the potential for significant property damage.

Relationship Between Home Value and Insurance Coverage Needs

As your home’s value increases due to improvements, your insurance coverage needs may also change. You need to ensure your coverage adequately protects you against financial losses in case of a covered event.

- Rebuilding Costs: The cost of rebuilding your home can increase significantly after renovations, particularly if you use premium materials or make significant additions. It’s essential to review your insurance policy and adjust your coverage limits to reflect the increased rebuilding costs.

- Replacement Cost Value: This type of insurance coverage ensures you receive the full cost of replacing damaged property, even if the replacement cost exceeds the original purchase price. This is particularly important after significant renovations that increase the value of your home.

- Consult an Insurance Agent: It’s crucial to consult with an insurance agent to review your coverage needs after making significant home improvements. They can help you determine if you need to adjust your coverage limits or explore additional coverage options to ensure adequate protection for your property.

Homeowners Insurance and Disaster Preparedness

Natural disasters can devastate homes and lives, causing significant financial losses and emotional distress. Having adequate homeowners insurance coverage is crucial to protect your financial well-being in the aftermath of such events. It provides financial support for rebuilding or repairing your home, replacing damaged belongings, and covering living expenses while you recover.

Disaster Preparedness Measures

Taking proactive measures to prepare for natural disasters can significantly mitigate potential losses and help you recover more quickly.

- Create a Disaster Plan: Develop a comprehensive plan outlining evacuation routes, communication strategies, and essential supplies needed for your family in case of an emergency.

- Secure Your Home: Strengthen your home’s structure by securing roof tiles, trimming trees, and reinforcing windows to withstand high winds or falling debris.

- Inventory Your Possessions: Maintain a detailed inventory of your belongings, including photographs and receipts, to expedite the insurance claim process after a disaster.

- Prepare an Emergency Kit: Assemble a kit containing essential supplies such as water, food, first-aid supplies, a flashlight, batteries, and a portable radio.

- Stay Informed: Subscribe to local weather alerts and emergency notifications to receive timely updates on potential disasters.

Ensuring Policy Coverage for Specific Disaster Risks

To ensure your homeowners insurance policy adequately covers disaster risks specific to your area, you should:

- Review Policy Exclusions: Carefully review your policy to understand specific exclusions and limitations related to disaster coverage. For example, some policies may have limitations on flood coverage or exclude certain types of natural disasters.

- Consider Additional Coverage: Depending on your location’s risk profile, consider purchasing additional coverage for specific hazards such as flood insurance, earthquake insurance, or windstorm insurance.

- Discuss Your Concerns with Your Agent: Communicate your concerns and specific disaster risks to your insurance agent to ensure your policy adequately addresses your needs.

Common Homeowners Insurance Claims

Homeowners insurance policies are designed to protect you against various financial losses that may occur due to unforeseen events. Understanding common types of claims can help you better assess your coverage and ensure you have adequate protection.

Types of Claims

The most common types of claims filed by homeowners are those related to:

- Weather-related events: This category encompasses claims arising from events such as hurricanes, tornadoes, hailstorms, floods, and wildfires. For example, a homeowner whose roof was damaged during a hailstorm might file a claim to cover repair costs.

- Theft: Home burglaries are a significant concern for homeowners, leading to claims for stolen property. If your belongings are stolen during a break-in, your insurance policy can provide compensation for the loss.

- Fire: Accidental fires, whether caused by faulty wiring, cooking accidents, or other factors, are a common source of claims. Homeowners insurance can cover damages to your property and belongings in the event of a fire.

- Water damage: Water damage can occur due to various factors, including burst pipes, leaking appliances, and flooding. Claims related to water damage can be substantial, covering repairs and replacement of damaged property.

- Liability: This category covers claims related to injuries or property damage that occur on your property. For instance, if a visitor trips and falls on your icy sidewalk, your insurance can cover medical expenses and potential legal costs.

Filing a Claim

When filing a claim, it’s crucial to act promptly and follow these steps:

- Contact your insurance company: Notify your insurer about the incident as soon as possible, typically within a specific timeframe Artikeld in your policy. This step initiates the claims process.

- Document the damage: Take photographs and videos of the damaged property, including any visible evidence of the cause of the incident. Detailed documentation will help support your claim.

- Keep records: Preserve receipts for any repairs or replacements you make. This documentation will be essential for reimbursement purposes.

- Be honest and accurate: Provide your insurer with accurate information about the incident and the extent of the damage. False or misleading information can jeopardize your claim.

- Follow instructions: Your insurance company will guide you through the claims process, providing specific instructions and deadlines. Adhering to these guidelines will ensure a smooth and efficient claim settlement.

It’s important to remember that your insurance policy may have specific limitations and exclusions. Familiarize yourself with these provisions to understand the extent of your coverage and avoid any surprises during the claims process.

Tips for Saving on Homeowners Insurance

Homeowners insurance is a significant expense, but there are ways to reduce your premiums and still maintain adequate coverage. By understanding your policy and exploring various discount options, you can save money on your insurance without compromising your protection.

Increasing Your Deductible

A higher deductible means you pay more out of pocket in the event of a claim, but it can also lead to lower premiums. This is because insurance companies assume less risk when policyholders agree to pay a larger portion of the claim. Consider increasing your deductible by a few hundred dollars or more, depending on your financial situation and risk tolerance. For example, increasing your deductible from $500 to $1,000 could result in a 10% to 15% premium reduction.

Bundling Policies

Bundling your homeowners insurance with other policies, such as auto or renters insurance, can lead to significant savings. Insurance companies often offer discounts for bundling policies, as they see you as a more valuable customer. By combining your policies, you can enjoy lower premiums and simplify your insurance management. For instance, bundling your homeowners and auto insurance could save you up to 25% on your combined premiums.

Maintaining a Good Credit Score

Believe it or not, your credit score can affect your homeowners insurance premiums. Insurance companies use credit scores to assess your financial responsibility and risk profile. A good credit score can make you a more attractive customer, leading to lower premiums. Aim for a credit score of 700 or higher to maximize your chances of receiving favorable rates.

Installing Safety Features

Installing safety features in your home, such as smoke detectors, fire alarms, and security systems, can make your home less prone to accidents and theft. Insurance companies often reward homeowners who take proactive steps to improve their home’s safety by offering discounts. For example, installing a monitored security system could earn you a 5% to 10% discount on your premiums.

Taking a Homeowners Insurance Course

Many insurance companies offer discounts to policyholders who complete homeowners insurance courses. These courses educate homeowners about insurance coverage, risk management, and claim procedures. By demonstrating your understanding of insurance principles, you can potentially earn a discount on your premiums.

Shopping Around for Quotes

It’s essential to shop around for quotes from multiple insurance companies to find the best rates. Each insurer has its own pricing algorithms and underwriting criteria, so you may find significant differences in premiums. Use online comparison tools or contact insurance agents directly to gather quotes and compare coverage options.

Negotiating Your Premium

Don’t be afraid to negotiate your premium with your insurance company. Explain your situation, highlight any safety improvements you’ve made, and ask if they offer any additional discounts. Insurance companies are often willing to work with loyal customers to find solutions that meet their needs.

Table of Discount Options

| Discount Option | Description | Potential Savings |

|---|---|---|

| Bundling Policies | Combining homeowners insurance with other policies, such as auto or renters insurance. | Up to 25% |

| Good Credit Score | Maintaining a credit score of 700 or higher. | Variable, depending on credit score and insurer. |

| Safety Features | Installing smoke detectors, fire alarms, security systems, and other safety features. | 5% to 10% |

| Homeowners Insurance Course | Completing a homeowners insurance course offered by your insurer. | Variable, depending on insurer and course content. |

| Loyalty Discount | Being a long-term customer of the same insurance company. | Variable, depending on insurer and policy history. |

| Claim-Free Discount | Having a clean claims history with no recent claims. | Variable, depending on insurer and claims history. |

Final Thoughts

In the end, securing the right homeowners insurance quote requires a proactive approach. By understanding the factors that influence premiums, comparing different providers, and leveraging available discounts, you can protect your most valuable asset while ensuring financial peace of mind. Remember, your home is your haven, and a well-informed decision about your insurance can make all the difference.